MonJa Launches Advanced Fraud Detection Feature for Safer Document Analysis. LEARN MORE

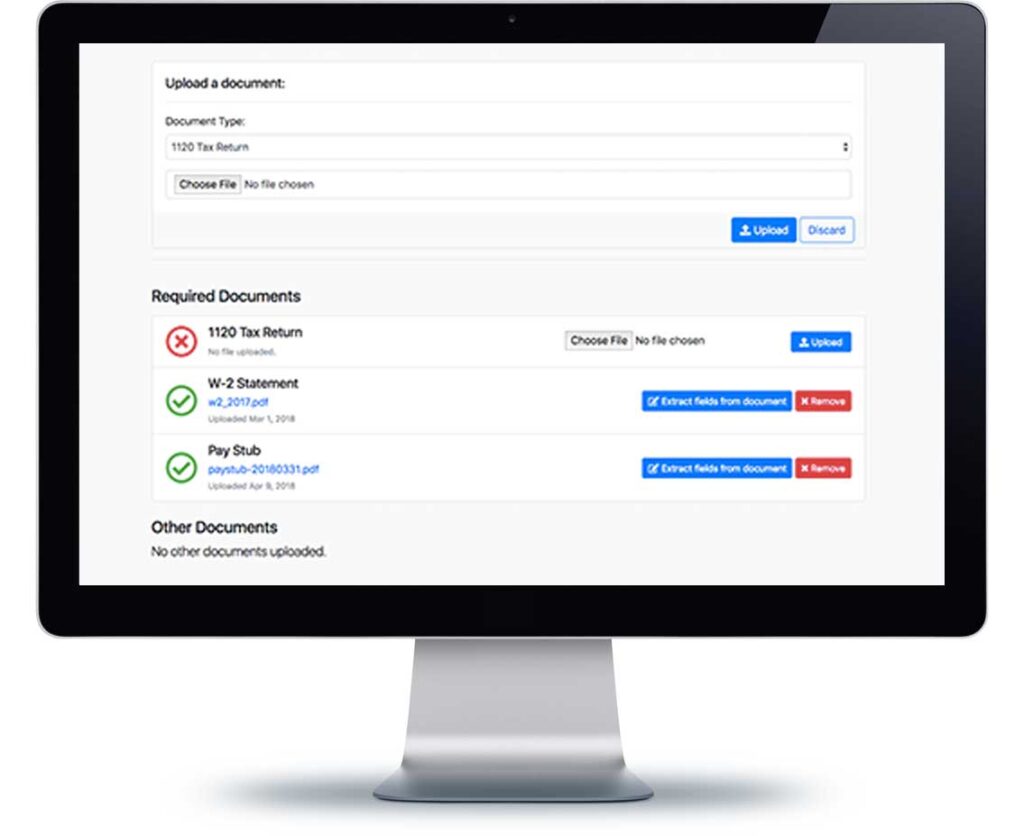

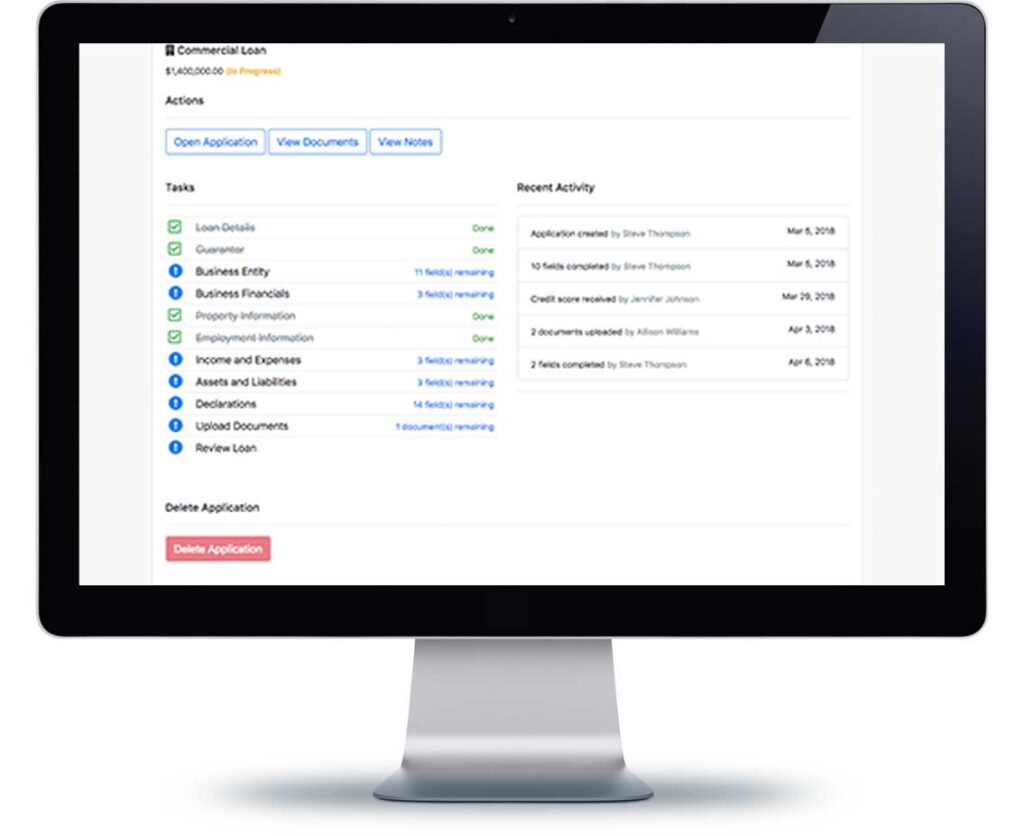

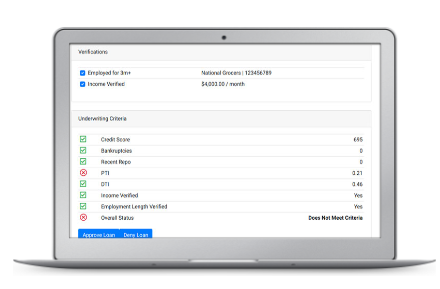

Don’t waste your precious time on manual document collection and verification. Focus on your clients instead!

Many lending systems provide software infrastructure, but leave you and your credit team with a lot of manual work. Alternatively, we offer a combination of technology and human support to minimize your time spent on loan application.