MonJa Launches Advanced Fraud Detection Feature for Safer Document Analysis. LEARN MORE

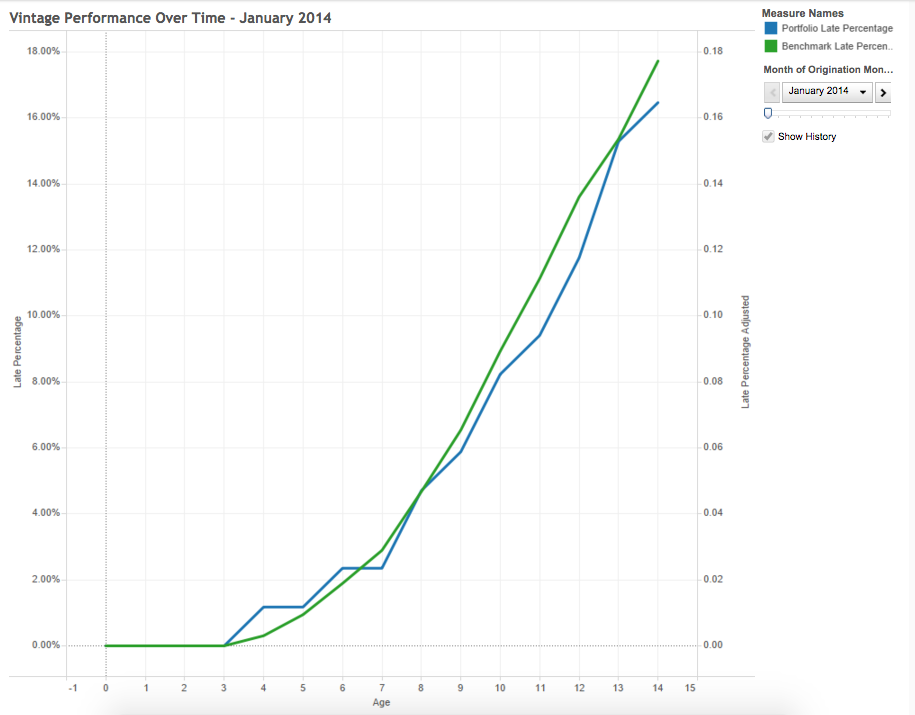

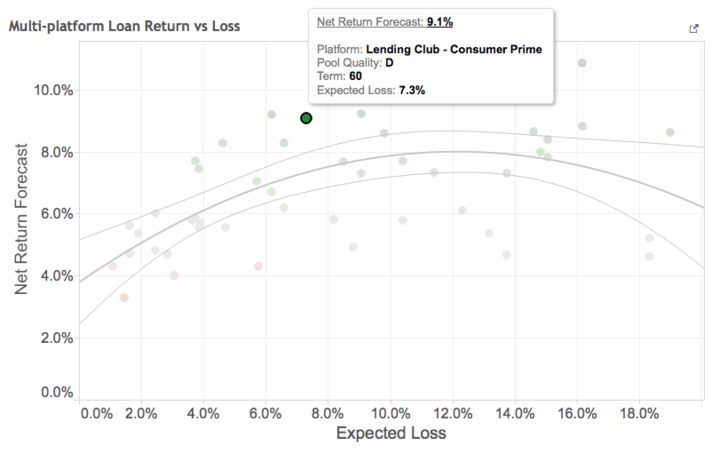

MonJa’s analytics provide actionable insights and help draw conclusions on what to do next. Our analytics focus on predictive credit modeling and portfolio analytics. We use data to go beyond reporting past and current performance. Our risk analytics focus on segmentation, predictive modeling, and macro scenario analysis for your P2P loan portfolios.

We use data to help increase returns, not just report it.

Today, we’d like to introduce two customizable and interactive modules that offer insights that fund managers can act on. With MonJa’s analytics, you’ll be able to:

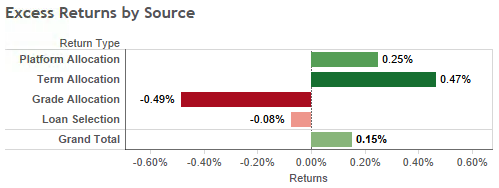

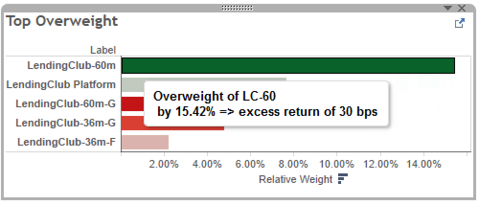

The Performance Attribution Tool allows you to understand the drivers of investment performance in a multi-platform loan portfolio. It quantifies the effects of a portfolio manager’s portfolio construction and selection strategies on the fund’s performance relative to its benchmark.

The report provides data-driven recommendations on different components that contributed to the portfolio’s performance. With a modified Brinson-Fachler methodology, our performance attribution models evaluate performance with a hierarchical allocation and selection decomposition to help investors understand the drivers of return in their portfolios.

The Performance Attribution tool attributes return to each investment decision, helping you refine investment strategies based on what has worked so far. Combined with the return forecasting tool, the MonJa platform helps you to regularly tune your investment allocation for the most optimal return and risk profile.