Since the end of 2015, the marketplace lending industry has been seen in a negative light. The news portrayal is a result of several events- the Lending Club upheaval, platform job cuts, consumer loan defaults, and more. Funds appeared to be performing poorly. As a result, investors have pulled back from investing, opting to wait and see how things play out.

However, MonJa has analyzed platform performance data over time to test the validity of investor concerns. A recent Forbes article by Nav Athwal (RealtyShares CEO) states “Recent news reports would have investors believe that the entire online lending sector is in trouble – when in fact, default rates remain largely in line with expectations and securitizations of consumer and student loans are on the upswing”. We expand upon this statement and performed drill-down analysis on certain portfolio variables.

Why Did Funds Appear To Have Poor Q1 Returns?

Most likely, it’s due to Fair Market Value adjustments.

Let’s take a look at Lending Club Advisor’s returns. (For further Lending Club return analysis, here’s a piece we wrote two months ago) While we don’t have inside knowledge of LCA’s accounting practices, we looked at the returns of a number of other funds using FMV, and the last five months have been challenging.

Lending Club commented on this topic:

In a letter to investors on Tuesday, LendingClub Chief Financial Officer Carrie Dolan said that valuation adjustments on existing loans, due to increases in interest rates charged for new loans to borrowers earlier this year, were driving the weaker performance.

While FMV methodologies differ, there are typically two reasons a fund would mark down the loans, independent of any actual losses:

1. Increasing primary origination interest rates: Similar to bonds, a change in discount rates will impact loan pricing. Lending Club has been increasing rates to bring investors onto the platform, making the older loans held by LCA (and everyone else) less attractive; hence the price adjustment to equalize returns.

2. Increase in forward expected losses: Lending Club has been revising the expected losses upwards, which LCA would most likely need to incorporate. Incorporating the newer loss curves will push down the NPV of the cashflow.

We estimate the spread duration of LCA’s blended portfolio is probably somewhere between 1.3 – 1.5, which means even a 50 bps in adjustments of #1 and #2 combined would mean a 75 bps return hit. If you take the adjustment all in one month, that can wipe out that month’s return entirely.

Key Take-Away: Better loans now make older loans look less attractive. The fair market value adjustments may give the perception that loans are underperforming.

What Can Investors Expect Going Forward? Prosper Shows Case For Optimism

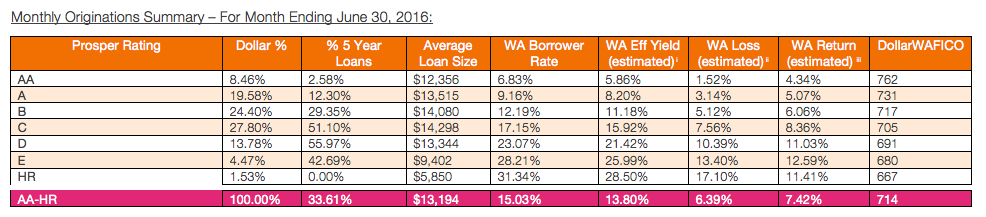

Moving past Q1 performance, certain funds have demonstrated performance improvement through Q2. In Prosper Platform’s June 2016 Performance Update, they highlighted an expected return of June 2016 production being just above the 7.4% on average.

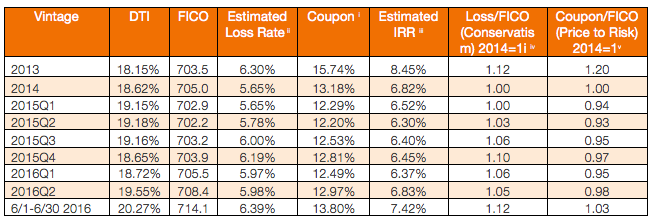

For more in depth portfolio analysis, here’s the full report. In addition to the return improvements, the vintages have seen in uptick in June 2016.

Specifically, the Estimated IRR has rose to 7.42% in June, exceeding the Q2 performance 6.82% mark. Prosper’s June performance gives positive signs to investors of future fund performance.

Conclusion:

To an outsider, marketplace lending funds may look terrible. While investors may be hesitant about marketplace lending, it’s imperative to drill down deeper in performance analysis to understand what underlies the caution. In this situation, examining fair market value explains fund performance inconsistencies. What other portfolio metrics can provide similar insights that give investors a more well-rounded perspective? It’s important investors know the full story, especially as they provide regular updates to their clients.