The Madden v. Midland Funding, LLC ruling proves the importance of understanding the regulatory risk faced when pricing any asset class- especially in marketplace lending. Below is the MonJa analysis on how this ruling effects p2p institutional investors.

First though, some of the facts:

- For a Madden v. Midland case overview, check out Lend Academy’s post “Madden 2015 Has Nothing to Do With Football”

- Outcome: The United States Court of Appeals for the Second Circuit held that the application of state usury laws to third-party assignees are not preempted by the National Bank Act (NBA) but rather such assignees remain subject to state usury limits.

So, what does this lawsuit loan mean for marketplace lending?

If Madden stands, the industry will likely have to undergo some structural changes in either how loans are funded, the rate charged borrowers or the amount of post-sale involvement a bank must retain. To hear Lending Club’s position on this case, check out “Renaud Laplanche on Madden v. Midland“.

What are the potential different outcomes of the Madden v Midland ruling?

- The most dramatic outcome of the ruling would be the complete forfeiture of the borrower’s loan balance–an immediate charge-off of all loans with interest rates greater than the applicable usury limit.

- Being optimistic even if the ruling stands, the courts could allow the platforms to reset the coupon to the respective state usury limit of each Madden impacted note (a “Madden Reset”). The lower interest rate charge would require an appropriate reduction in the monthly installment payment, holding the term & loan size constant. The investor sacrifices a portion of their monthly cash flow stream to avoid a complete loss.

What exactly does the Madden v Midland case mean for marketplace lending investors?

For many marketplace lending investors with exposures to states with usury laws, a Madden Reset will have a significant impact on the portfolio. To fully appreciate the cost to investors, we use a static-replication rational pricing method to estimate the haircut of newly issued notes right after a reset occurs.

We start with relaxed assumptions:

- The risk & pattern of Default and Prepayment are held constant

- Default and prepayment are homogenous across Madden impacted notes

- Unlimited supply of Madden notes can be purchased at par

Under the assumed framework, a portfolio manager can match the previously expected cash flow by simply buying more Madden notes. We estimate the cost of replacing the cash flow via the dollar cost of the additionally purchased notes.

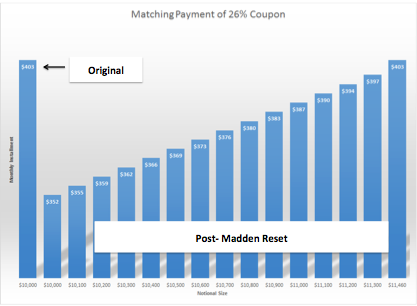

Below is the cash flow of a 36m 26% coupon with a notional amount of $10k compared to cash flows of a similar term note of 16% (the New York State civil usury threshold) with varying notional amount :

Each bar represents the monthly cashflow corresponding to a principal level, post-Madden Reset. In the example above, an additional $1,460 of notes are needed to match the initial cash flow which equates to a 14.6% reduction in value.

Note that this is a simplified model, as cashflow is not an exogenous factor to borrower risk. If we remove the assumption of the constant and homogenous risk of default and prepayment, the scenario below may somewhat overstate the haircut, given that under the new cashflow scenario:

a. The risk of Default stays the same or decreases

b. The risk of Prepayment stays the same or increases

The lower payments from the Madden Reset improves the free cash flow of the borrower–the risk of default is either the same or lower. Fewer notes could be purchased with the improved likelihood of being repaid. But the additional income would also make it more likely the borrower can retire the debt sooner with increased monthly payments within a shorter length of time.

The Bottom Line

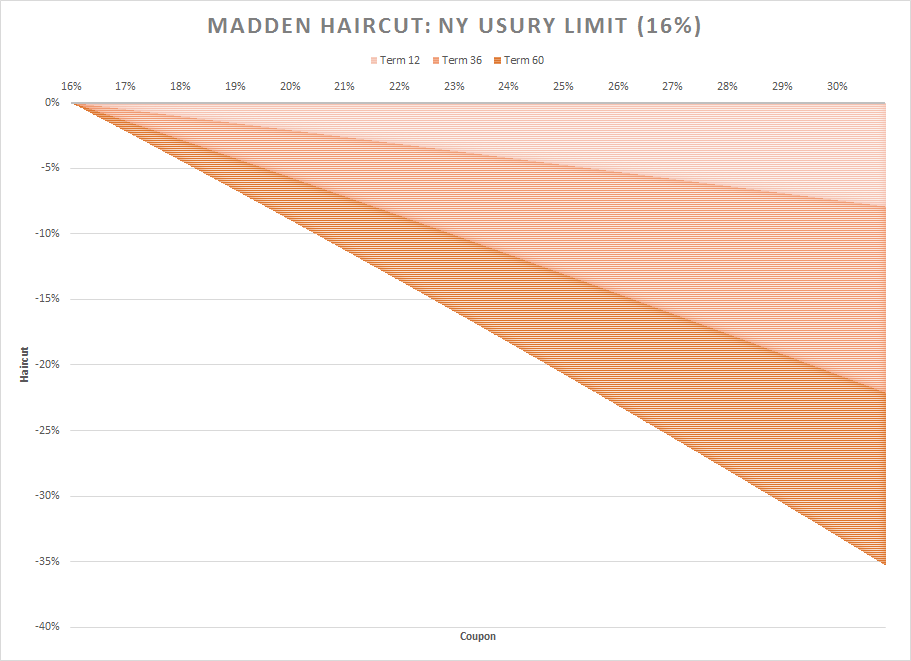

Below is an illustration of the haircut estimate for new origination loans in New York State subject to a Madden Reset:

It follows that the impact of the haircut is greater when

1. The reduction of a coupon is greater

2. The term of the loan is longer

It may be years before the dust settles and we understand the full financial impacts of this decision. Despite all the excitement and growth of the marketplace lending industry, this is a reminder that there are still some outstanding regulatory uncertainties that need to be considered during the investment process.