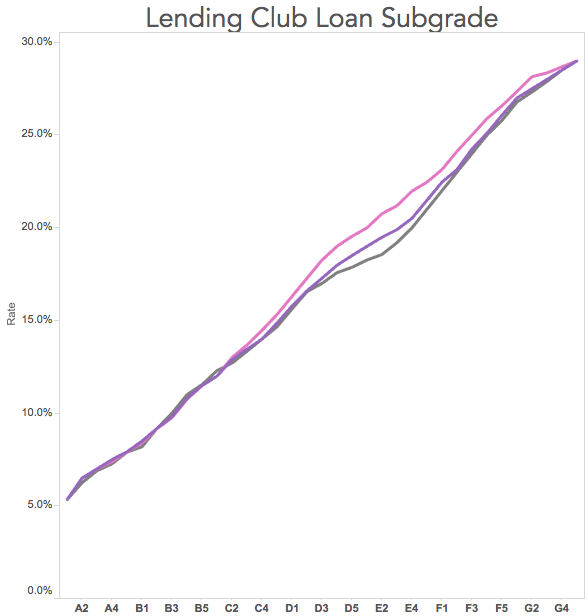

A few days ago, Lending Club increased it’s borrower rate – second time in two months, after the December hike that coincided with the Fed rate hike. Investors should read Lending Club Advisor’s Commentary of 2016 for more background on the rate changes. In addition to the Fed rate hike, LC’s interest rate change may be caused by the prime rate rise and expected credit risk increasing. Our following chart details the rate increase:

A couple observations:

- The largest increase is in the D, E, and F grades, going as high as +1.3% in some subgrades.

- The magnitude of the increase was much larger than the Q4 2015 rate change

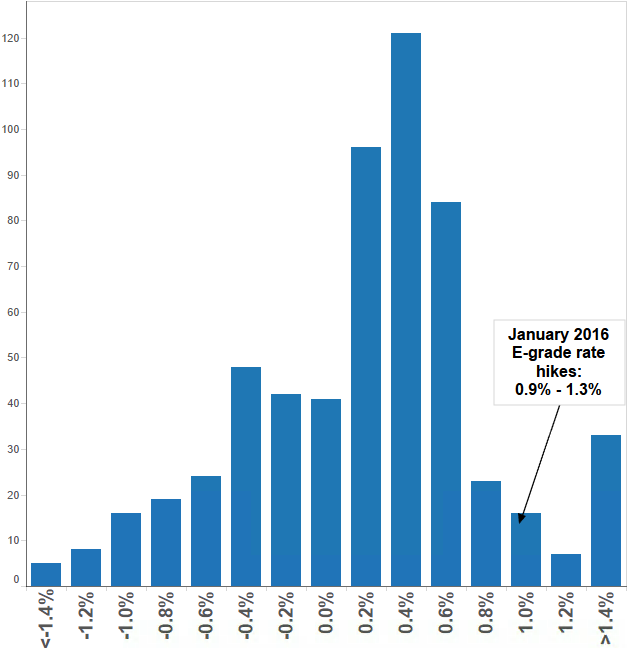

For more context, below is a histogram of all Lending Club interest rate changes from 2007 to Q3 2015.

The changes are indeed significant compared with typical rate changes from Lending Club; in the affected grades, the loans are now pricing in an extra 0.7% to 1.3% additional returns for investors. It will be prudent for investors to incorporate this new information in the loan purchase composition.