The news at Lending Club was a shock to everyone in the direct lending world. The process failings and potential business / legal ramifications have been discussed ad nauseam – and they are extremely serious. Several institutional investors have pulled back on their purchasing programs, for good reasons. Lending Club needs to show investors that the same problems will not be repeated, and the burden of proof is firmly on them.

While investors are rightfully cautious given this news, it would be prudent to also look beneath the major headlines and examine Lending Club’s credit quality. Few organizations have done this. Here’s our perspective:

Background

Recall that right before LC’s quarterly earnings release, we published a post stating our concerns about the underwriting problems. Ironically, in the data releases that coincided and followed the earnings release, we have seen evidence of improving underwriting, which potentially points to some changes that make the marketplace loans more attractive to some investors.

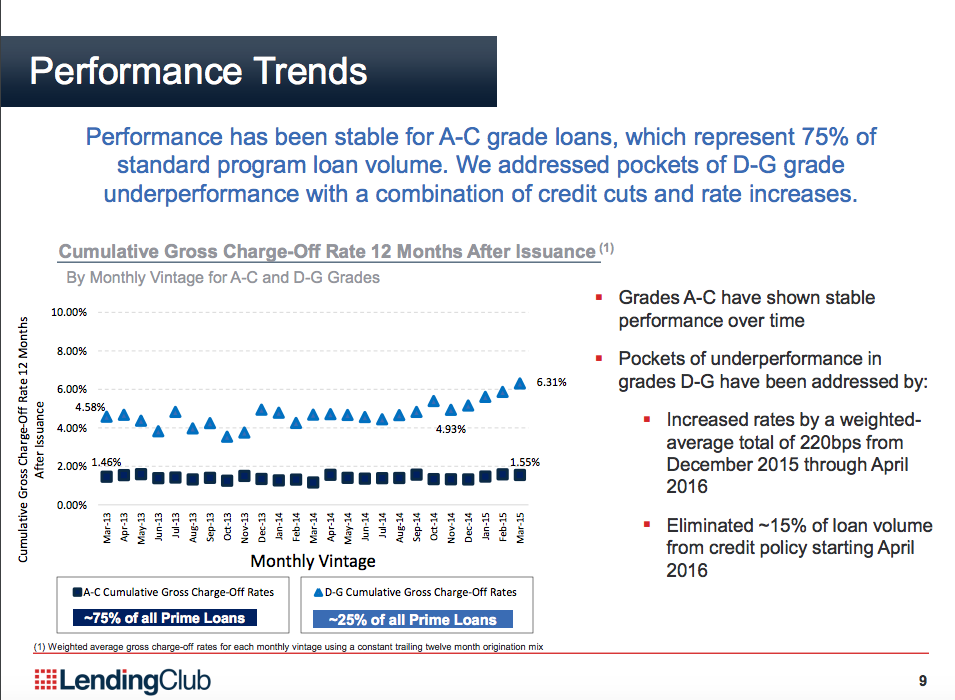

In the quarterly earnings presentation, LC dedicated an entire slide about loan performance:

Note the bullet: “Eliminate ~15% of loan volume from credit policy starting April 2016”. The underperformance was first highlighted in Lending Club’s disastrous LC Advisor note – but this time Lending Club provided more details, along with action items. Buried in the 10-Q was more details about what they actually did in the underwriting process:

We also eliminated an underperforming population from the platform’s credit policy that was mainly characterized by high indebtedness, an increased propensity to accumulate debt and lower credit scores, and accounted for slightly less than 5% of loan volume on an annualized basis.

When reviewing this statement, two things stand out:

1) Borrowers with “high indebtedness”

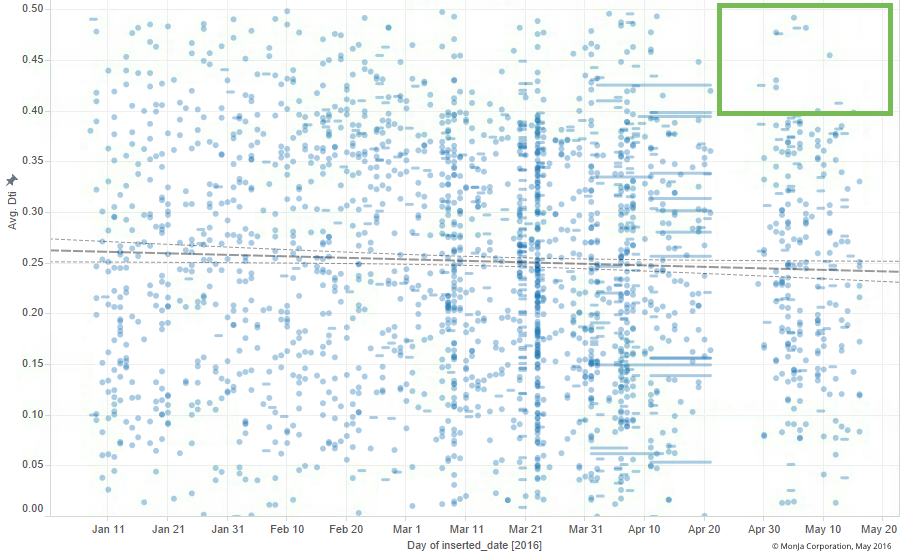

Lending Club’s most recent quarter release provided some clues to what was specifically eliminated from the population. In the borrower population, “high indebtedness” probably refers to the borrowers that have a high debt-to-income ratio. The chart below is an example of a sub-population that appears to have much fewer high DTI borrowers starting April, highlighted with the green box:

Debt to income ratio – Lending Club “D” 36m loan population

Perhaps not coincidentally, some of the loans eliminated came from the “direct pay” program. According to Lending Club, the “direct pay” feature requires a borrower to use up to 80% of their loan proceeds to pay off outstanding debt and may reduce the borrower’s DTI. In theory, since there is more assurance that the loan is used to directly reduce outstanding debt, investors should have a greater willingness to take on borrowers with a high DTI ratio. In practice, the assurance that the loans will be used for its stated purpose is probably not enough to compensate for the lower risk premium priced into these loans.

2) “Increased propensity to accumulate debt”

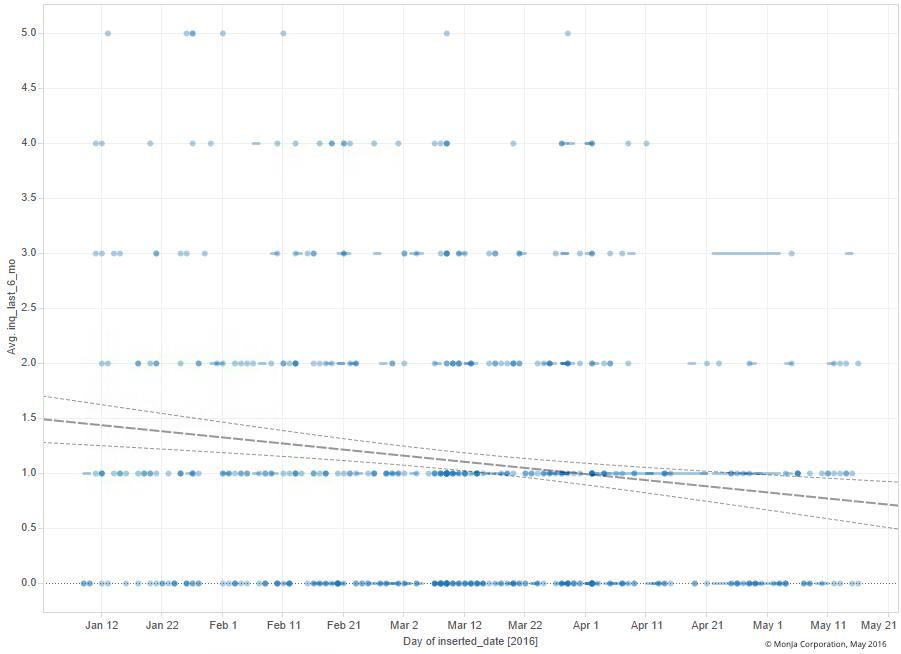

The “increased propensity to accumulate debt” refers to borrowers that have a number of recent credit inquiries on file within the last 6 months. Recent credit inquiries are a sign that the borrower is actively seeking credit, and a high number of inquiries is a marker for potentially risky borrowing behavior.

Empirically, loans from borrowers with a higher number of inquiries tend to perform worse; this was an indicator that appeared to be slowly creeping up in the last few quarters, which may have played a part in the higher than expected delinquency rates of the impacted vintages. In the chart below, you can see that LC pretty much-eliminated borrowers with 4 and 5 inquiries in the 36M F/G segment starting from the middle of April – a dramatic reversal of the trend of increasing inquiries.

Number of inquiries – Lending Club “F/G” 36m loan population

Takeaways

As mentioned earlier, Lending Club has a number of fairly serious issues to deal with, at least in the short term. However, assuming Lending Club can navigate the immediate crisis at hand – ultimately investors will focus on the performance of loans over the long term. On that front, we see reasons to be cautiously optimistic.