How did Community Banks and Credit Unions go above and beyond to support local communities during the COVID-19 crisis?

[vc_row][vc_column][vc_column_text]Read time: 6 minutes [/vc_column_text][vc_column_text]In this article, we cover some inspiring examples of how some Community Banks and Credit Unions went above and beyond to support local businesses, their communities, and employees during the COVID-19 crisis. The tanking of the global economy has ensured more severely on small local businesses. Bigger enterprises are almost always […]

MonJa's Digital Banking and Lending Monthly Roundup | June 2020

[vc_row][vc_column][vc_column_text]6 Minutes Read MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. […]

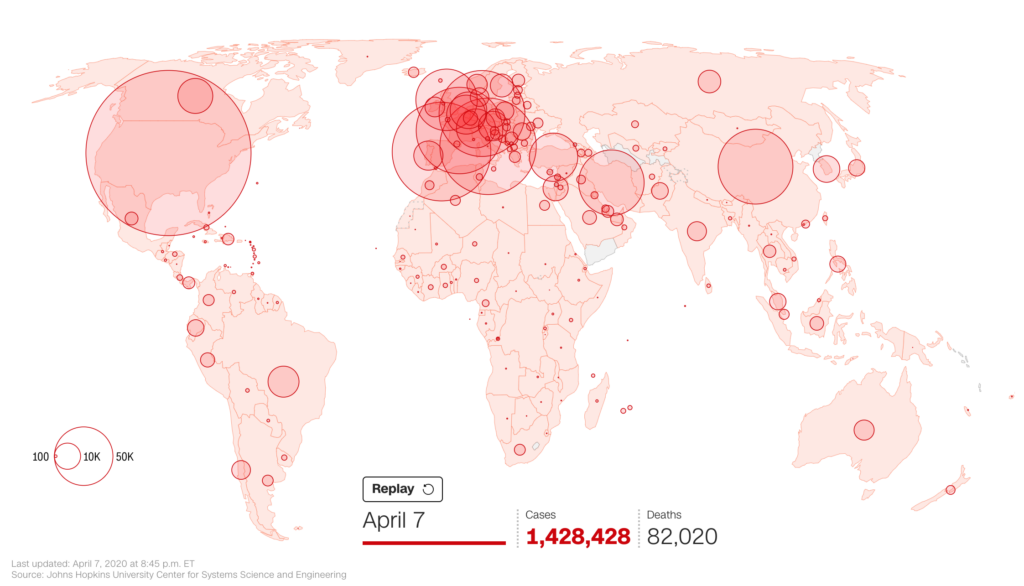

COVID-19 Impact on Small Business Lending Industry

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The coronavirus outbreak has hit the main street-side economy in the gut and it has been unleashing devastation all over the world. Medical authorities are racing to drug trials to slow down and prevent the virus from spreading but success currently eludes the medical community. So, the question is how did […]

MonJa's Digital Banking and Lending Monthly Roundup | May 2020

[vc_row][vc_column][vc_column_text]6 Minutes Read MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. […]

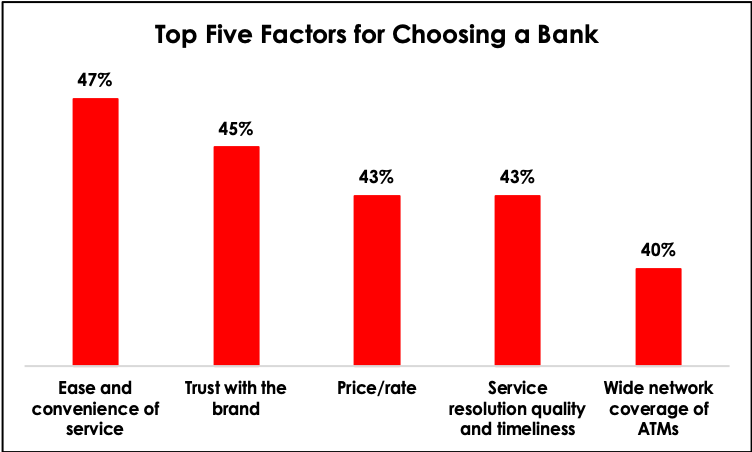

7 Benefits of Digitalization to a Bank's Existing Client Base

Introduction There was a time when doing banking transactions used to be a very difficult and time-consuming task. You had to stand in a long queue to conduct basic financial transactions such as withdrawing cash or depositing money. Thanks to secured atm services and later to the digitalization, the users can perform all these transactions at […]

MonJa's Digital Banking and Lending Monthly Roundup | April 2020

[vc_row][vc_column][vc_column_text]6 Minutes Read MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. […]

Banking in the Times of Coronavirus: Do’s and Don’ts

[vc_row][vc_column][vc_column_text]Read time: 6 minutes [/vc_column_text][vc_column_text]The ongoing spread of COVID-19 carries with it one of the biggest threats to disrupt the global economy and financial markets. In this article, we are talking about banking in the times of coronavirus. We cover what are bank’s Do’s and Don’ts in these unprecedented times. Lockdown has led to a […]

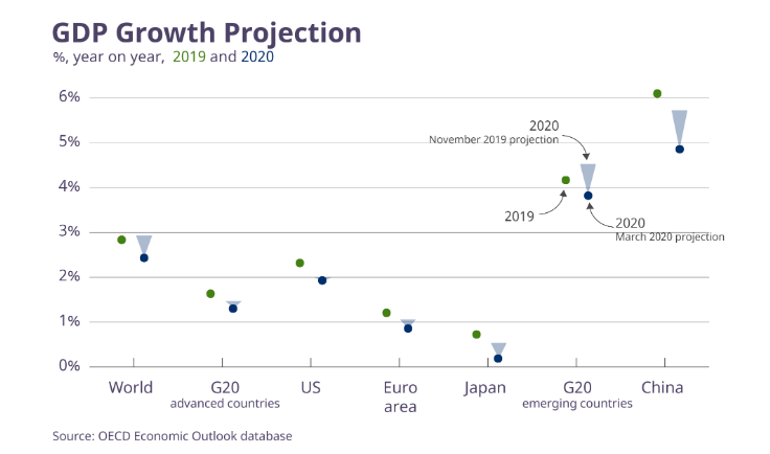

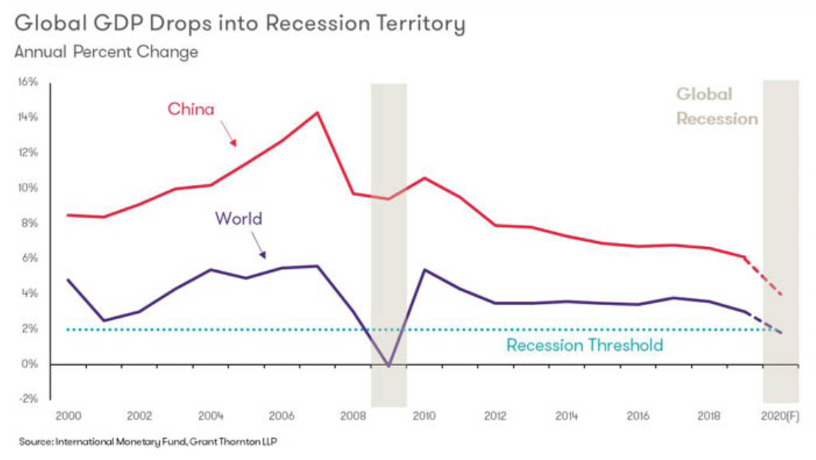

COVID-19 and Recession: A Banking Perspective on Survival

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The sudden outbreak of the COVID-19, the novel coronavirus pandemic has led to a severe lockdown. The sudden shutdown of the multiple industries and businesses has threatened and disrupted the global economy and financial markets. COVID-19 has ushered in a recession after more than a decade of stable economic growth. The […]

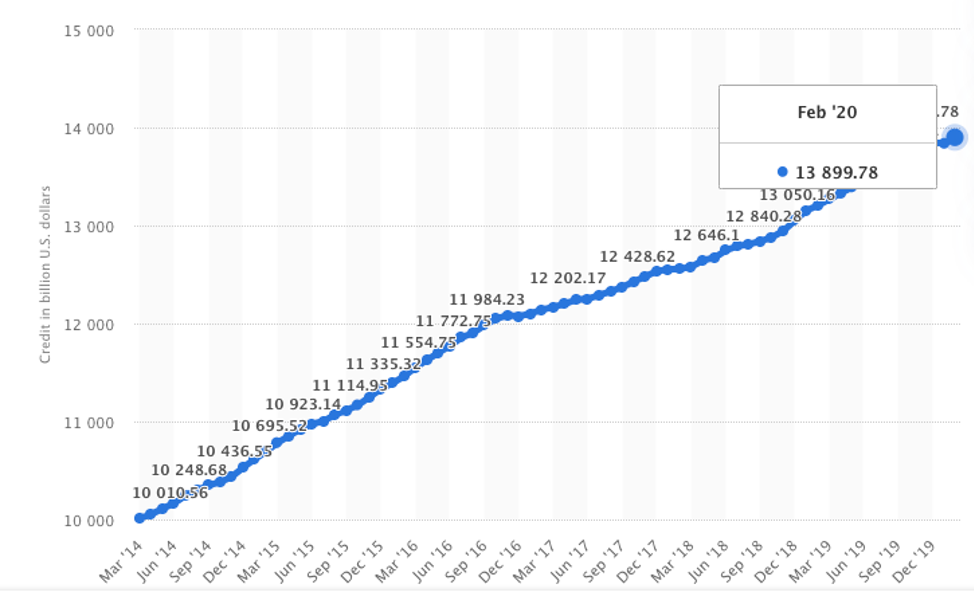

8 Low-Risk Loan Portfolio Strategies For Banks In The Coronavirus Environment

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]COVID-19 has pushed the economy into a recession. Unless a small business is applying through the Payroll Protection Program, banks do not really have the appetite to fund small businesses. But if you assess the pre-COVID situation, commercial banks have been able to increase their loan portfolios massively over the last […]

Top 7 Predictions on Coronavirus and its Impact on the Lending Industry

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The outbreak of the deadly respiratory virus, COVID-19 has been catastrophic for humanity. The pandemic carries with it a potentially equally disruptive economic fallout. The COVID-19 virus, which till now has spread across six continents and 100+ countries, had been officially declared as a Public Health Global Emergency by the World […]