Why Marketplace Lending Fund Returns Look Terrible

Since the end of 2015, the marketplace lending industry has been seen in a negative light. The news portrayal is a result of several events- the Lending Club upheaval, platform job cuts, consumer loan defaults, and more. Funds appeared to be performing poorly. As a result, investors have pulled back from investing, opting to wait […]

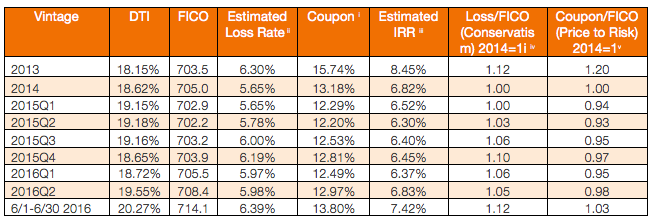

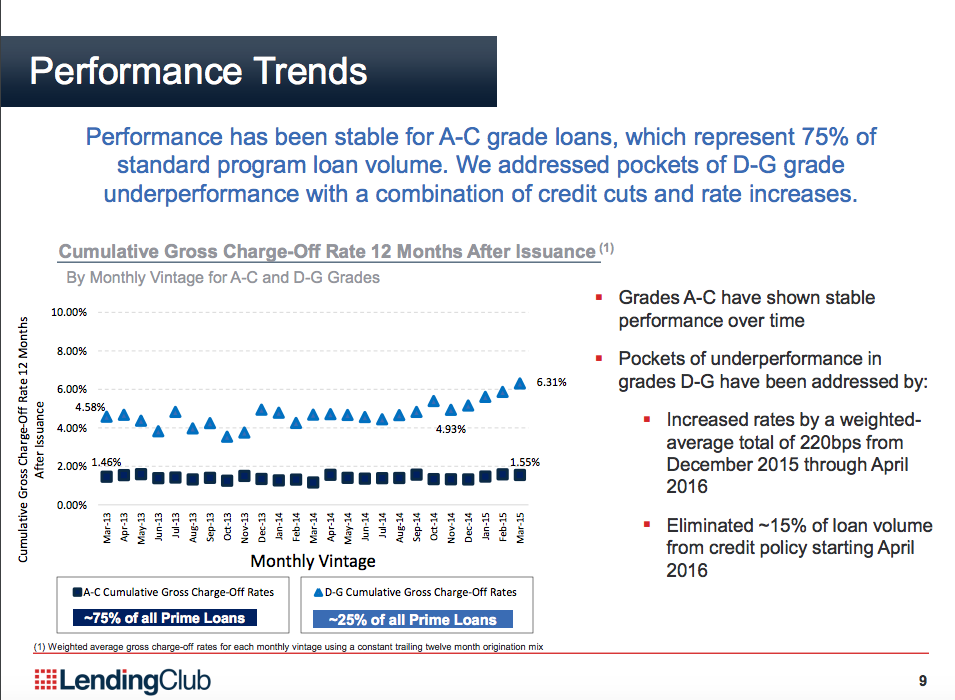

Changes in Lending Club Underwriting – Looking Beneath the Headlines

The news at Lending Club was a shock to everyone in the direct lending world. The process failings and potential business / legal ramifications have been discussed ad nauseam – and they are extremely serious. Several institutional investors have pulled back on their purchasing programs, for good reasons. Lending Club needs to show investors that […]

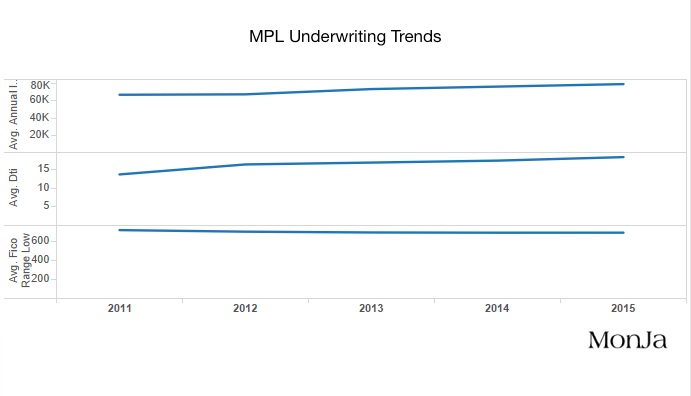

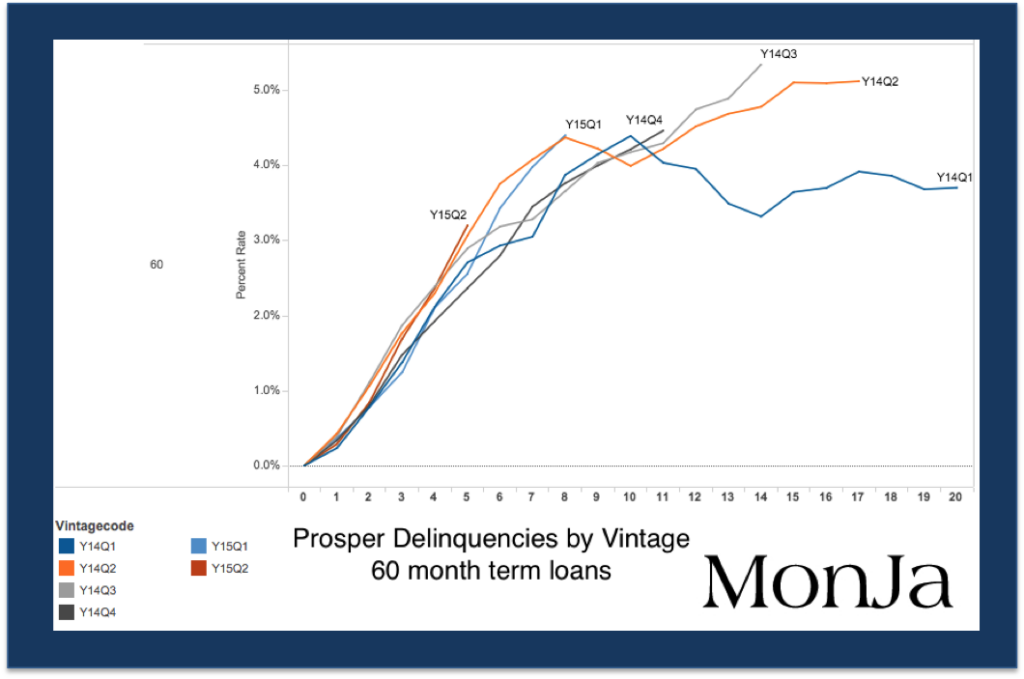

Marketplace Lending Analysis: Understanding The Recent Uptick In Delinquencies

We’ve all read the recent headlines. Since late 2015, sentiments have changed in the marketplace lending sector and investors have expressed concern. As an independent risk analytics platform, MonJa is often asked its if credit quality is deteriorating in the marketplace lending space and if investors need to readjust their expectations about the quality of […]

Moody's "downgrades" Prosper-backed deal despite consistent performance

Earlier this month, Moody’s put the C notes of the Prosper/ Citi securitizations CHAI 2015-PM1 / 2015-PM2 / 2015-PM3 on a review for downgrade. The most material change in the forecast was an increase of expected cumulative lifetime net loss to 12%, from 8% to 8.5% of the 3 transactions. On the reason for this […]

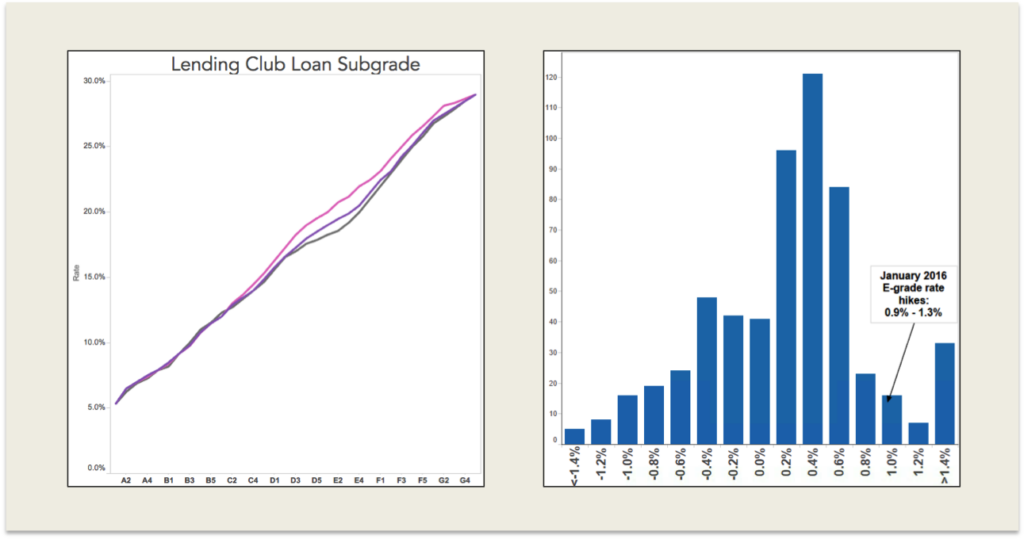

How significant is Lending Club's recent rate hike?

A few days ago, Lending Club increased it’s borrower rate – second time in two months, after the December hike that coincided with the Fed rate hike. Investors should read Lending Club Advisor’s Commentary of 2016 for more background on the rate changes. In addition to the Fed rate hike, LC’s interest rate change may be caused by the […]

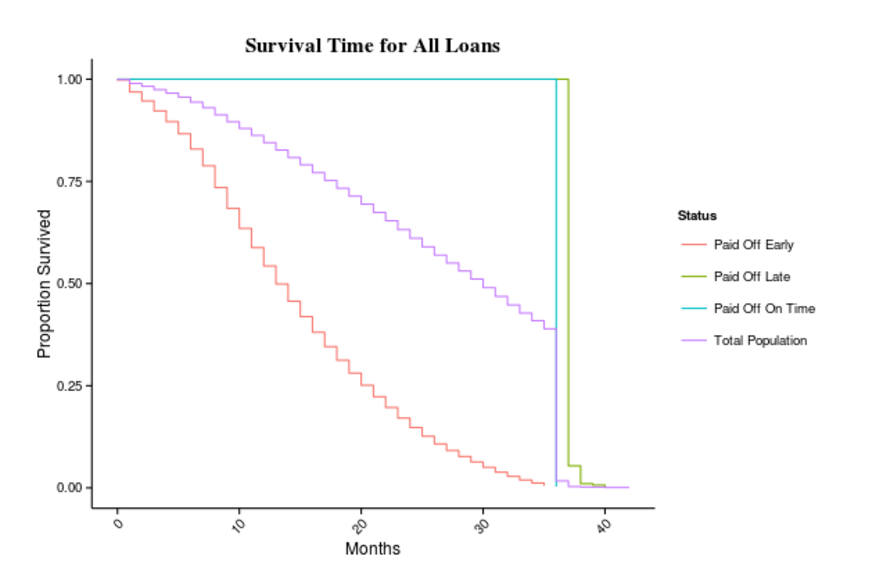

Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

Growth in Marketplace Lending Spawns Specialized Risk Services and Tools

With the growth of marketplace lending, institutional investors need to manage their risk exposure. It’s important to understand what makes this market different from other asset classes and how to employ tools and models tailored for its risks. Originally written by Katherine Heires and posted by GARP Risk Intelligence on November 19, 2015, this article highlights different […]