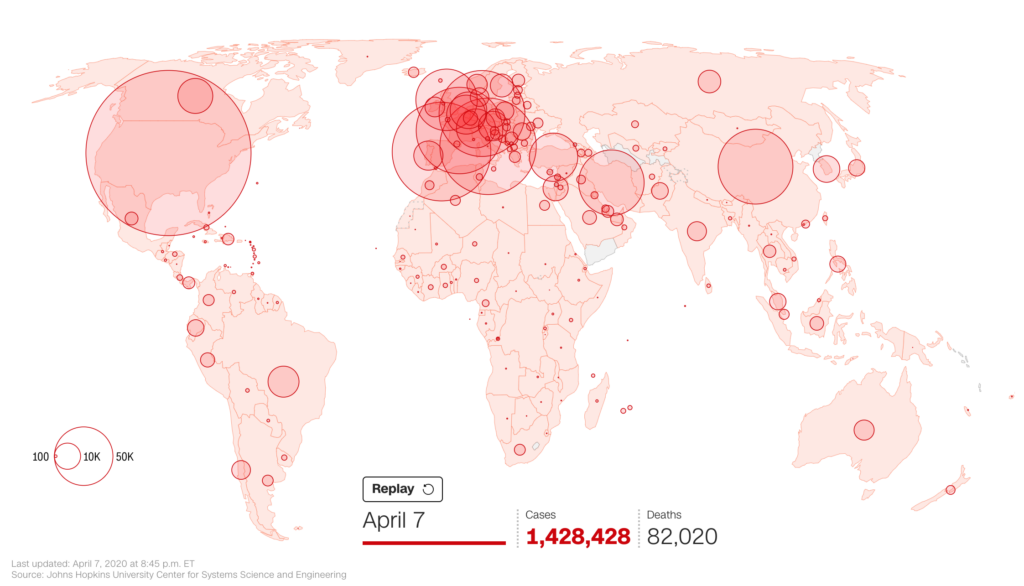

COVID-19 Impact on Small Business Lending Industry

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The coronavirus outbreak has hit the main street-side economy in the gut and it has been unleashing devastation all over the world. Medical authorities are racing to drug trials to slow down and prevent the virus from spreading but success currently eludes the medical community. So, the question is how did […]

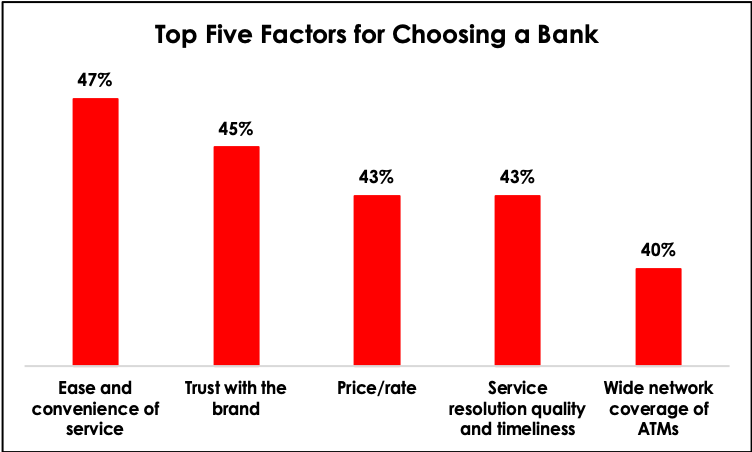

7 Benefits of Digitalization to a Bank's Existing Client Base

Introduction There was a time when doing banking transactions used to be a very difficult and time-consuming task. You had to stand in a long queue to conduct basic financial transactions such as withdrawing cash or depositing money. Thanks to secured atm services and later to the digitalization, the users can perform all these transactions at […]

Banking in the Times of Coronavirus: Do’s and Don’ts

[vc_row][vc_column][vc_column_text]Read time: 6 minutes [/vc_column_text][vc_column_text]The ongoing spread of COVID-19 carries with it one of the biggest threats to disrupt the global economy and financial markets. In this article, we are talking about banking in the times of coronavirus. We cover what are bank’s Do’s and Don’ts in these unprecedented times. Lockdown has led to a […]

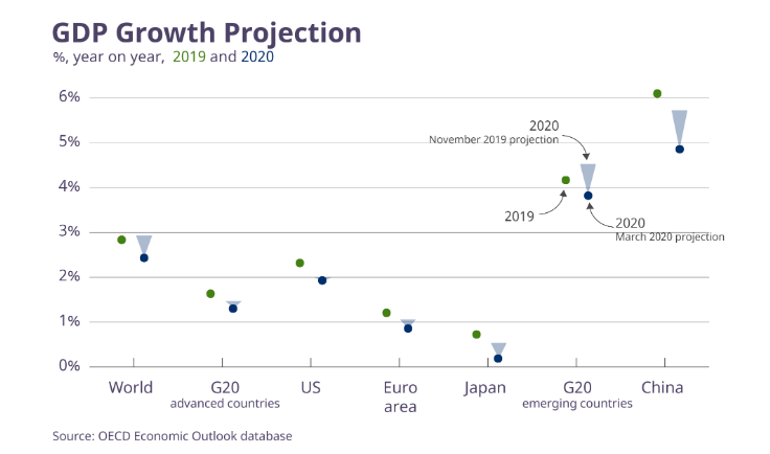

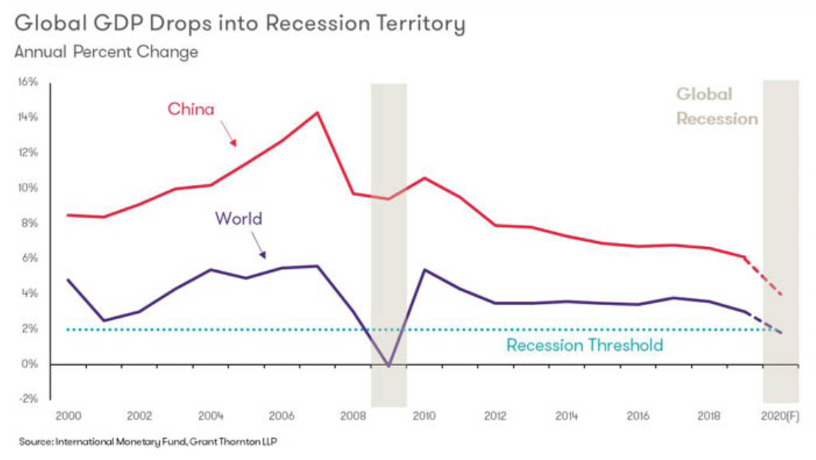

COVID-19 and Recession: A Banking Perspective on Survival

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The sudden outbreak of the COVID-19, the novel coronavirus pandemic has led to a severe lockdown. The sudden shutdown of the multiple industries and businesses has threatened and disrupted the global economy and financial markets. COVID-19 has ushered in a recession after more than a decade of stable economic growth. The […]

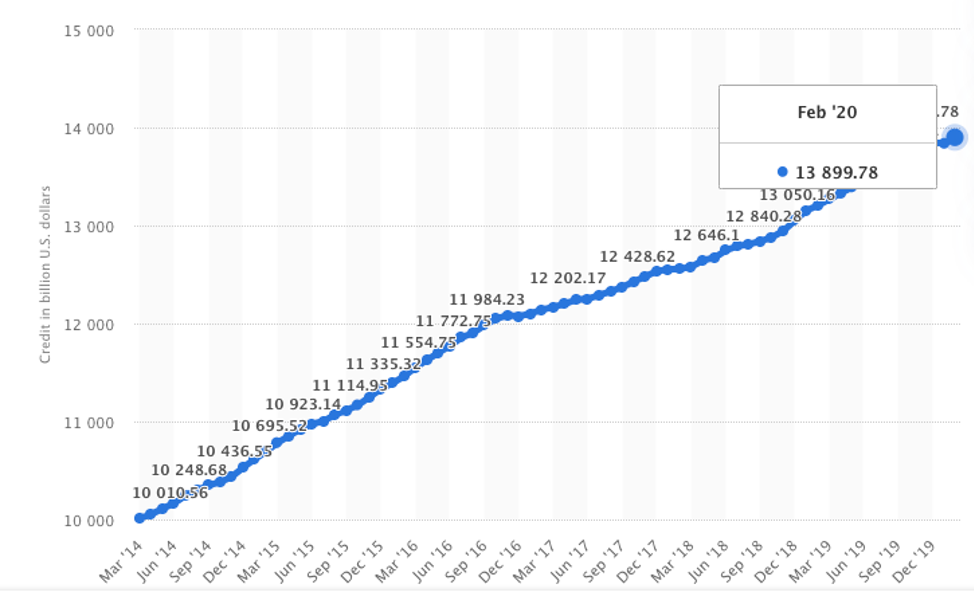

8 Low-Risk Loan Portfolio Strategies For Banks In The Coronavirus Environment

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]COVID-19 has pushed the economy into a recession. Unless a small business is applying through the Payroll Protection Program, banks do not really have the appetite to fund small businesses. But if you assess the pre-COVID situation, commercial banks have been able to increase their loan portfolios massively over the last […]

Top 7 Predictions on Coronavirus and its Impact on the Lending Industry

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The outbreak of the deadly respiratory virus, COVID-19 has been catastrophic for humanity. The pandemic carries with it a potentially equally disruptive economic fallout. The COVID-19 virus, which till now has spread across six continents and 100+ countries, had been officially declared as a Public Health Global Emergency by the World […]

Banks: To Stay Relevant – Build Partnerships With Fintech

[vc_row][vc_column][vc_column_text]Read time: 5 minutes Fintech allows community banks and credit unions to compete with the larger financial conglomerates. Most banks are likely already utilizing some fintech, but the addition of artificial intelligence and machine learning produces better outcomes. For example, automated loan underwriting software can help a bank to increase the number of applications that […]

How Can a Bank Increase Revenue By Accessing Fintech Automated Underwriting?

[vc_row][vc_column][vc_column_text]Read time: 6 minutes [/vc_column_text][vc_single_image image=”10314″ img_size=”large” alignment=”center”][vc_column_text] Introduction Any lending business faces a challenge with modern banking processes. How can your institution balance the loan amount with the time spent underwriting to ensure that loan processing is profitable and functions as a revenue stream generator? Luckily, your institution can use Fintech automated underwriting software […]

Can a Bank Quickly Streamline Loan Underwriting With the Help of Fintech?

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text] Introduction Manual underwriting processes make typical commercial loans (especially complex ones) extremely time-consuming for community banks and credit unions to analyze and underwrite. Financial institutions and lenders that use digital technology and tools, supported by risk assessments and artificial intelligence (AI), can process loans much faster and more efficiently. Companies […]

3 Reasons for a Bank To Tap Into Outside Loan Underwriting Services

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text] Introduction The financial lending landscape evolves constantly and often community banks and credit unions falter when adopting new technology. You need to make sure customer data is safe for your reputation and make sure you have fast data access when undergoing audits, all while maintaining a competitive edge. An obvious […]