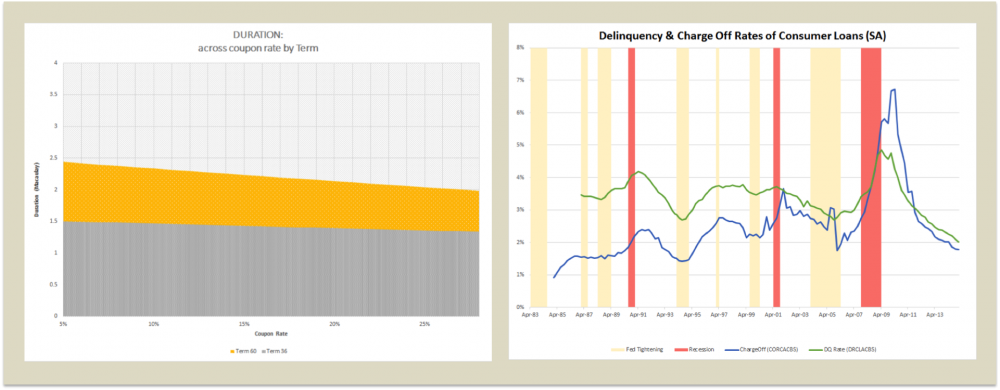

4 Ways An Interest Rate Hike Will Impact Investors

This post was originally featured on October 5, 2015, in Orchard Platform’s Thought Leadership Series, where blog series where marketplace lending leaders share their industry insights. Below I share insights gained from my 10+ years of experience overseeing the loss forecasting of $9+ billion diverse small business lending products and managing $100+ billion in retirement assets. On […]

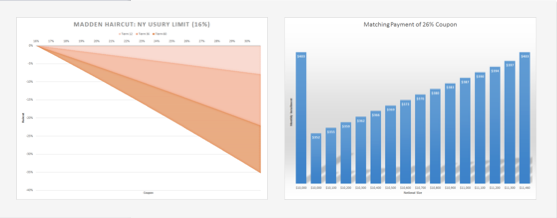

What's The Madden With You?

The Madden v. Midland Funding, LLC ruling proves the importance of understanding the regulatory risk faced when pricing any asset class- especially in marketplace lending. Below is the MonJa analysis on how this ruling effects p2p institutional investors. First though, some of the facts: For a Madden v. Midland case overview, check out Lend Academy’s post […]

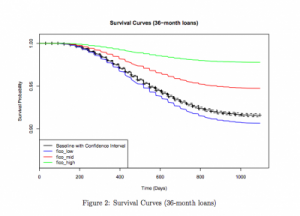

Survival Analysis Applied to Marketplace Loans

MonJa would like to introduce Professor Matthew Dixon, whose current research interests include credit modeling for peer-to-peer loans. Over the last several months, Prof Dixon and Litong Dong, a recent graduate of USF, have engaged in a collaborative research project with us here at MonJa. Their research focuses on survival analysis and how it might apply […]