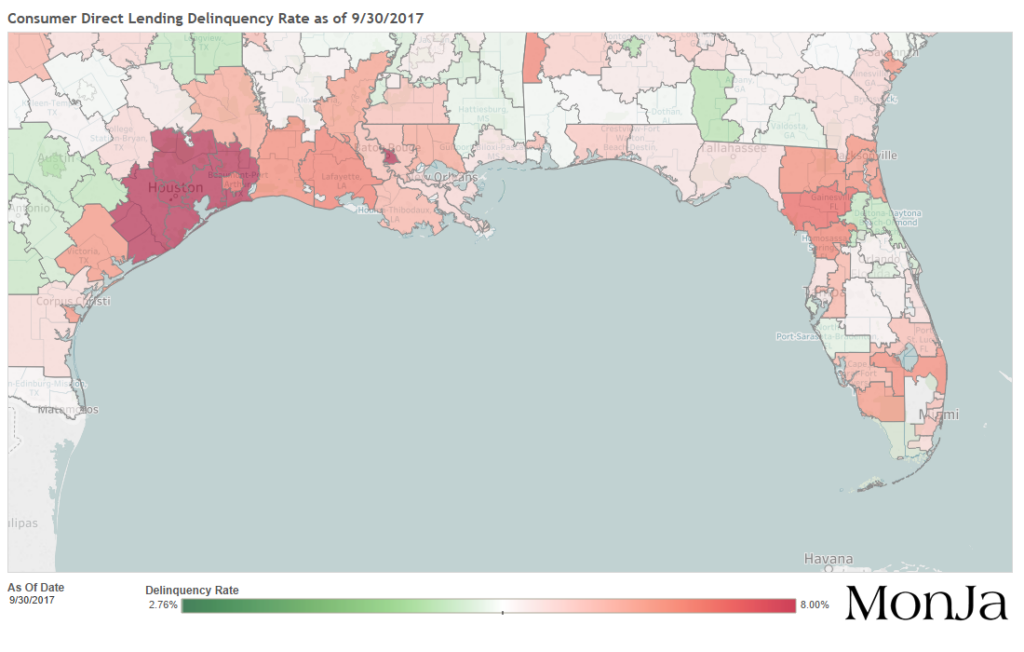

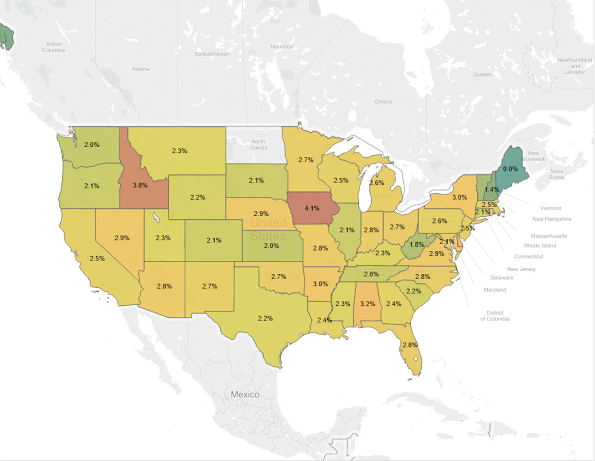

Hurricanes Harvey and Irma's impact on loan performance

Based on our observations, Hurricanes Harvey and Irma had a sizable impact on consumer loan performance and delinquency rate during September 2017 among affected borrowers. Please see below for our analysis

Why Marketplace Lending Fund Returns Look Terrible

Since the end of 2015, the marketplace lending industry has been seen in a negative light. The news portrayal is a result of several events- the Lending Club upheaval, platform job cuts, consumer loan defaults, and more. Funds appeared to be performing poorly. As a result, investors have pulled back from investing, opting to wait […]

Changes in Lending Club Underwriting – Looking Beneath the Headlines

The news at Lending Club was a shock to everyone in the direct lending world. The process failings and potential business / legal ramifications have been discussed ad nauseam – and they are extremely serious. Several institutional investors have pulled back on their purchasing programs, for good reasons. Lending Club needs to show investors that […]

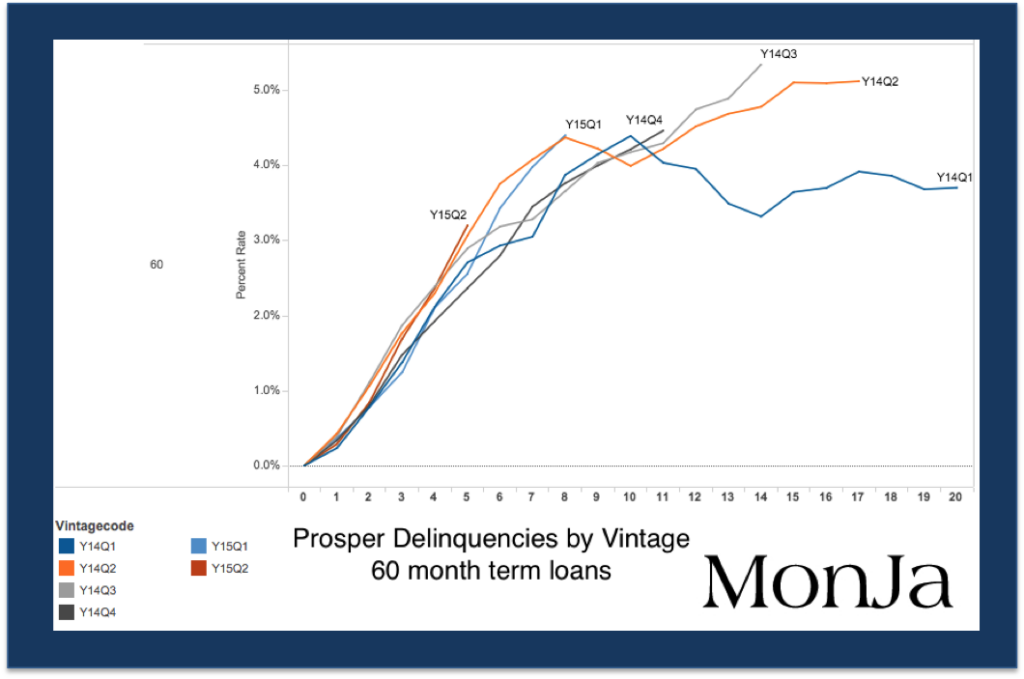

Moody's "downgrades" Prosper-backed deal despite consistent performance

Earlier this month, Moody’s put the C notes of the Prosper/ Citi securitizations CHAI 2015-PM1 / 2015-PM2 / 2015-PM3 on a review for downgrade. The most material change in the forecast was an increase of expected cumulative lifetime net loss to 12%, from 8% to 8.5% of the 3 transactions. On the reason for this […]

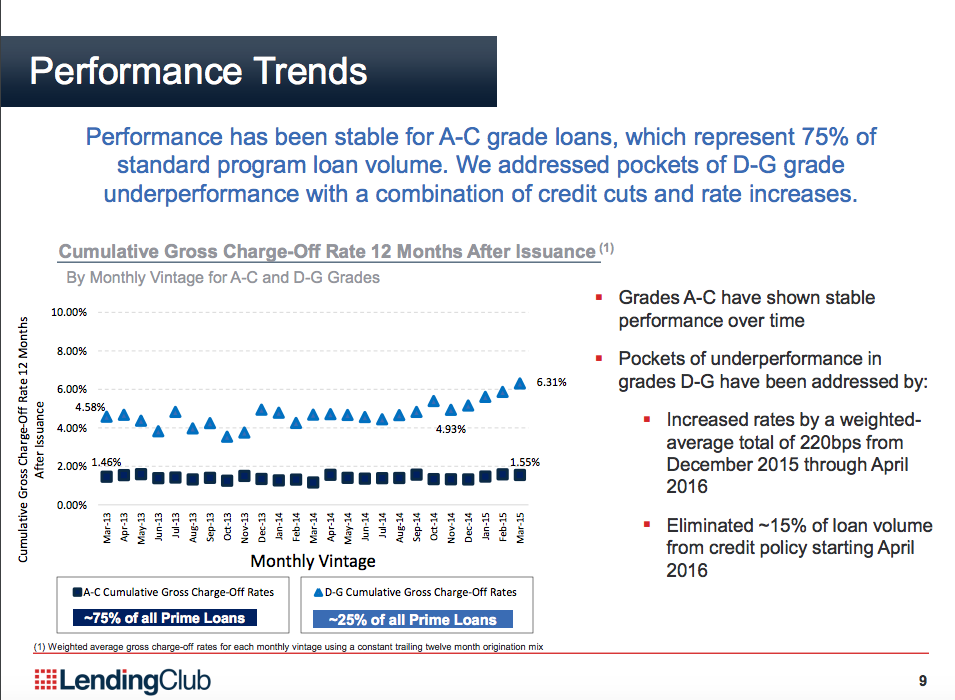

Lending Club Performance – The Good And The Bad (Feb 2016)

As I previously wrote, some of the recent coverage on Lending Club’s credit performance is somewhat one-sided, and we believe Lending Club’s loan performance is broadly in line with expectation. That said, the actual performance depends on the specific segment in question, which we will explore in greater detail in this post. Similar to what […]

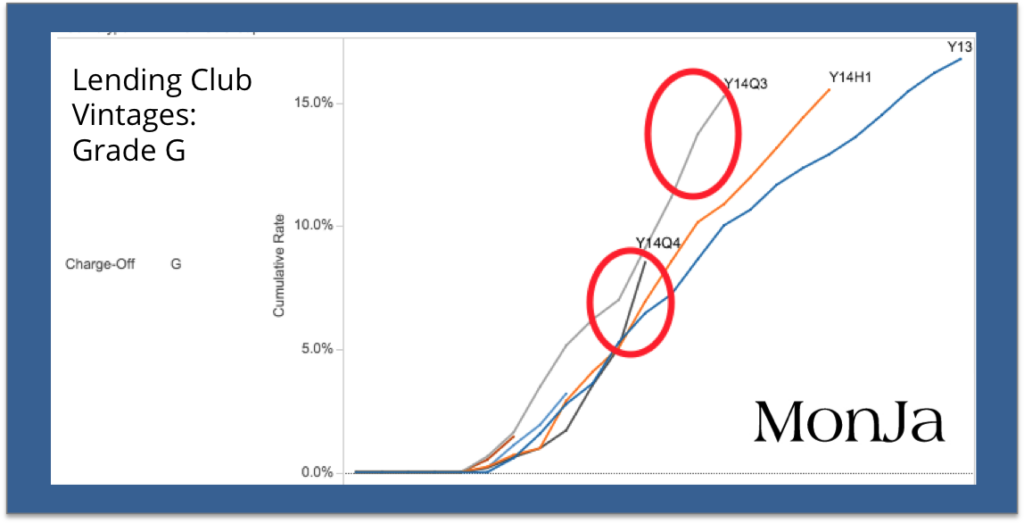

LendingClub did not "misfire" in their underwriting

Late last week, there was a Bloomberg Business article on LendingClub’s recent “misfiring” of loan origination models. While I personally enjoy most of Bloomberg’s coverage of marketplace lending (positive or negative), this article appears to have taken a recent LC-Advisor report out of context. Below are a couple actual data points on LendingClub’s underwriting performance: […]

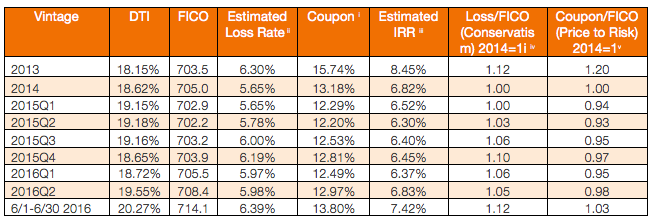

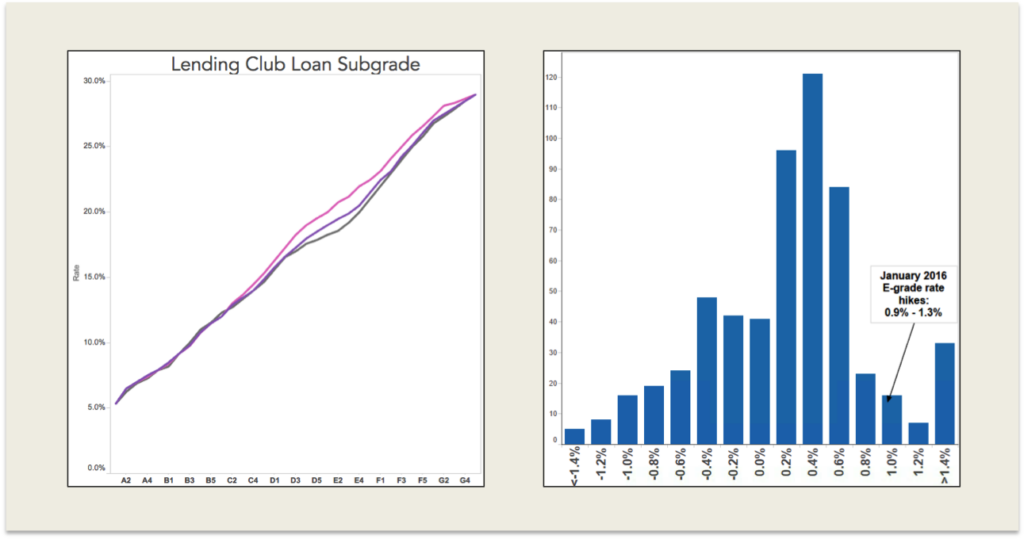

How significant is Lending Club's recent rate hike?

A few days ago, Lending Club increased it’s borrower rate – second time in two months, after the December hike that coincided with the Fed rate hike. Investors should read Lending Club Advisor’s Commentary of 2016 for more background on the rate changes. In addition to the Fed rate hike, LC’s interest rate change may be caused by the […]

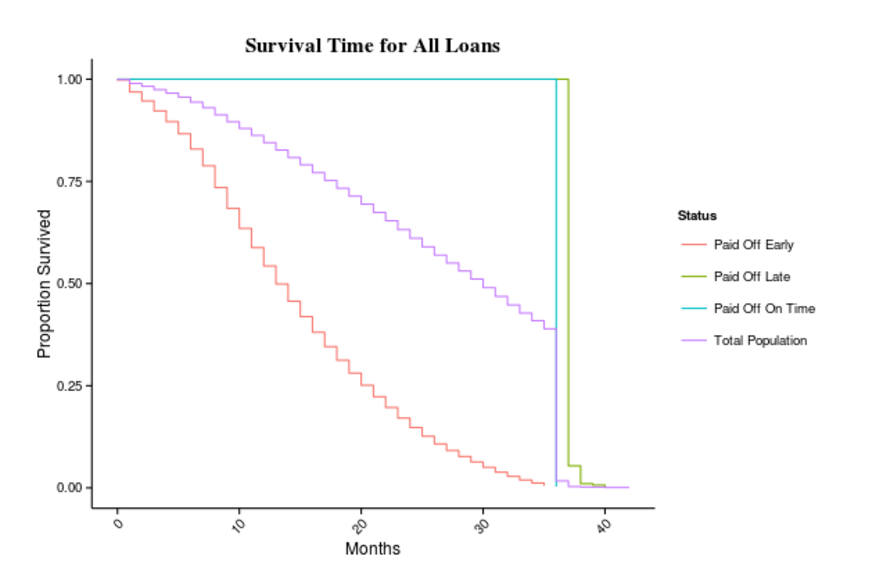

Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

Top 3 Marketplace Lending Insights in 2015

Over this past year, the MonJa team has provided our credit risk insights (and our intern’s cartoon drawings) on our company blog. Investors and partners often refer to these entries (common comment: “Your team really knows what it’s talking about…” Well geez, thanks. Only been in credit risk analytics for 20 years…). These comments have led to […]

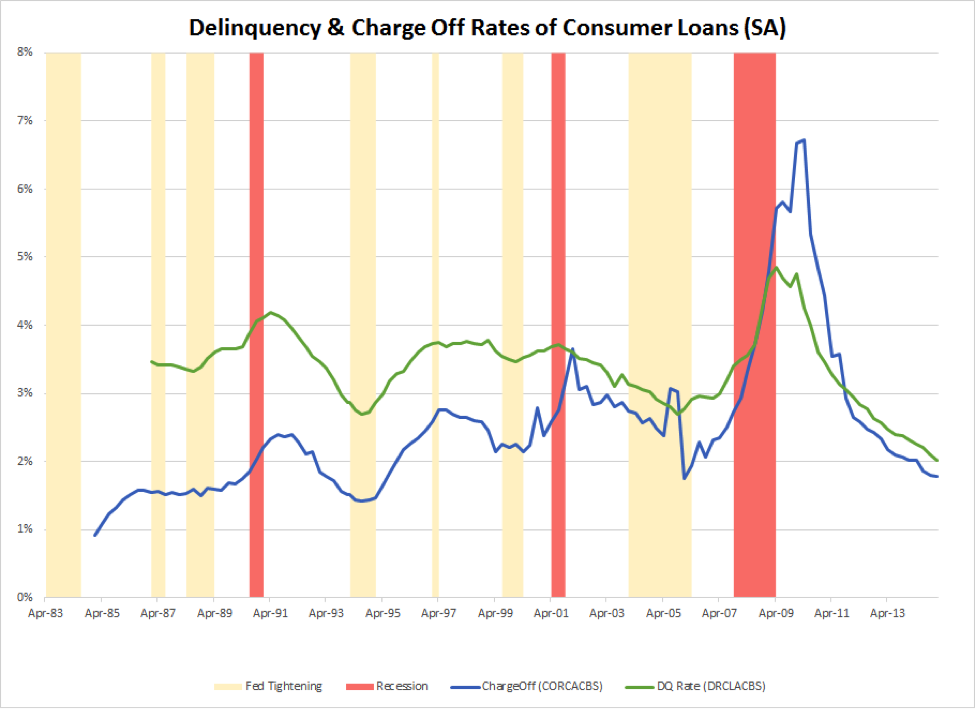

How Can Loan Investors Prepare For Economic Shock?

As the end of the year approaches, many investors trying to find how to invest $500 show concern about the potential slowdown in the economy. This caution is with good reason, as the slowdown in China and lull in US job growth point to a high likelihood of the US economy being affected. A recent Washington Post Article, “Economists are starting to […]