MonJa is excited to announce their five part blog series “5 Common Mistakes P2P Loan Investors Make”. With the growth of peer-to-peer lending, more institutional investors are investing in marketplace platforms. There are several introductory guides out there on p2p lending, yet investors are applying sophisticated credit strategies in buying loans- something basic guides don’t address. As MonJa has been working with clients on their loan strategy and portfolio analytics, we’ve seen common patterns in the mistakes institutional investors are making. As the leader in market insights for marketplace lending, we are sharing our analytical insights in hopes that institutional investors will truly understand what’s working in their portfolio.

5 Mistakes P2P Loan Investors Make – Insufficient Diversification (Part 1 of 5)

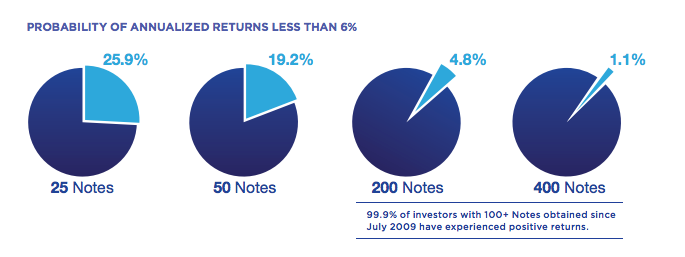

One of the basic building blocks of an investment portfolio is diversification. You’ll often notice investors use stocks, bonds, mutual funds, and other asset types as means to diversify their portfolio. Similarly, investors in marketplace lending diversify their portfolio by spreading their dollars across different types of loans. Among the key players in the peer to peer lending industry, typical advice is to invest in at least 200 loans because you can reduce the probability of earning returns of less than 6%.¹

Source: Prosper

That’s definitely a great advice to invest in more notes, but it is ultimately insufficient in guiding investors to appropriate diversification. Lending Club and Prosper offer automated plans to help diversify your loan portfolio, but you’ll only receive average returns. Investors who want higher returns need to choose their loans carefully and look at the loans individually. A good investor should consider investing across different loan grades, vintages, geographies, loan purposes, and lending platforms.

Institutional investors especially need to pay more heed to platform diversification because each lending platform has different characteristics. While Lending Club and Prosper only accept people with a credit level that is average, good, or excellent, Avant accepts people with broader credit levels. Investing through multiple underwriters help mitigate the risk of underperforming for certain vintages because of different underwriting issues. One major difference between Avant and Lending Club is that Avant issues the debt itself and takes on the risk when the loan defaults, while Lending Club relies on investors to provide the capital and handles the underwriting.² According to Moody’s Investor’s Service, it’s important to understand how different lending platforms manage their loan servicing because some companies might loosen underwriting standards to increase origination volume. While a company, such as Lending Club, may benefit from expanding their business, they would not be impacted if their loans were to default.³

By diversifying between borrowers and platforms under the MonJa model, investors are able to optimize returns and increase investment performance. In a later article, we will also talk about diversification across asset types (e.g. small business, real estate, etc), and how it helps investors manage risk factors specific to single asset types.

_____

¹ http://www.lendingmemo.com/wp-content/uploads/2013/09/Prosper-Diversification.pdf

²http://www.cnbc.com/2014/12/03/ahead-of-lending-club-ipo-avantcredit-raises-mega-round.html

³http://qz.com/310682/the-incentive-problem-at-the-heart-of-peer-to-peer-lending/