This post was originally featured on October 5, 2015, in Orchard Platform’s Thought Leadership Series, where blog series where marketplace lending leaders share their industry insights. Below I share insights gained from my 10+ years of experience overseeing the loss forecasting of $9+ billion diverse small business lending products and managing $100+ billion in retirement assets.

On September 17 the Federal Reserve announced interest rates would remain unchanged, stating the US economy still needs time to recover from the recession. While some breathed a sigh of relief, we shouldn’t expect the status quo to remain for much longer. Last week Fed chairwoman Janet Yellen said the Fed still plans to raise its benchmark interest rate later this year.

With interest rates expected to rise before year-end, marketplace lenders need to be prepared. As marketplace lending is a new industry, we’ll be moving into uncharted territory. So the natural question rises- how will marketplace lending be impacted by the interest rate hike?

Earlier this year, Bill Ullman commented on this blog and made some very good points that while rate hikes are traditionally viewed as big negatives for fixed income investments, the true effects may be more nuanced, and not all bad. I want to revisit the potential effects of a rate hike and expand on Bill’s work.

From an investment credit risk and analytical perspective, there are certain events institutional investors should be prepared for. The shorter end of the yield curve is most sensitive to the Fed rate increase, and we investigate how the upward shift in the yield curve will impact marketplace lending in the following four areas- price return risk, reinvestment risk, prepayment risk, and credit risk. This article provides a detailed credit risk analysis of what marketplace lending can expect in each of these areas.

MARKET RISK

What To Expect: Changing interest rates can impact the present value of the instrument’s cash flows. In short, this is because as rates rise (fall), the price of the instrument falls (rises). So it’s important to understand how sensitive the security will be to a changing yield curve.

How It Works: Typically the sensitivity to interest rate changes is measured by duration, an estimate of how long it takes for the instrument to be repaid via internal cash flows. While there are many different flavors of calculations for durations, the basic principle of the measure is the lower the number, then the less exposure the bond has to changes in interest rates. Marketplace lending notes have attributes that lower the duration exposure compared to the typically fixed income instrument.

Three key attributes of marketplace lending notes that reduce price sensitivity to interest changes are:

- Short-maturity length

- High Coupon Payments

- Amortized Monthly cash flows include both interest & principal

These three qualities result in a lower estimated duration because cash flows are received much earlier than a traditional bond payment structure, muting the effect of a change in the yield curve.

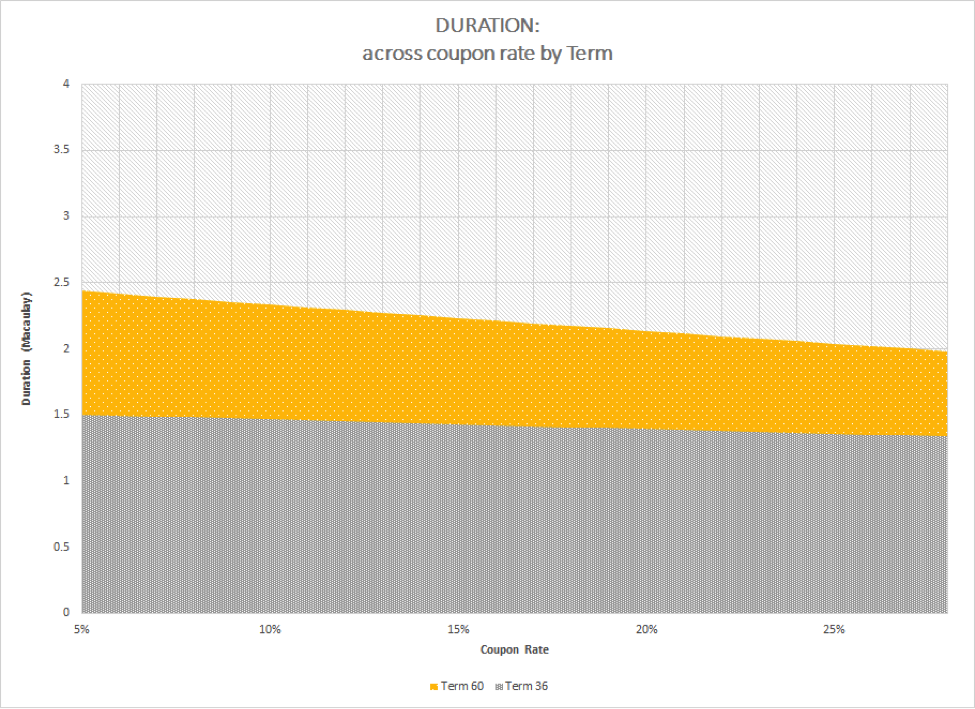

The above chart illustrates the relationship between the duration of amortized loans and the term length of a loan and loan’s coupon rate. The amortization schedule of the note distributes the cash flows evenly across the life of the note, so duration would likely never be more than half the term of the loan. We further identify that duration is greater for longer term notes with lower coupon rates

The note most sensitive to a change in yield in the chart would be term length of 60 months with a 5% coupon. We estimate the potential change of value by multiplying the duration estimate with the change in yield, where a 100bps increase across the yield curve exposes the note to an almost 2.5% loss in value.

However, two factors should be considered to better understand what this loss of value actually means.

-

- (1) Price changes are limited to when notes change hands, which very few off-the-run marketplace lending notes do. If an investor expects to hold the note until maturity, then changes in price are immaterial as the cash flows will be realized with no loss of capital.

- (2) The loss to the investor is buffered by the investment income earned from the note.

Drawing a quick comparison of marketplace lending notes to the Barclays Aggregate index, the total bond index has an estimated duration of 5.7 and a weighted average coupon of about 3.3%. A 100 bps increase in rate would result in a capital loss near 5.7 %, a discount in value almost twice as large as the coupon.

REINVESTMENT RISK

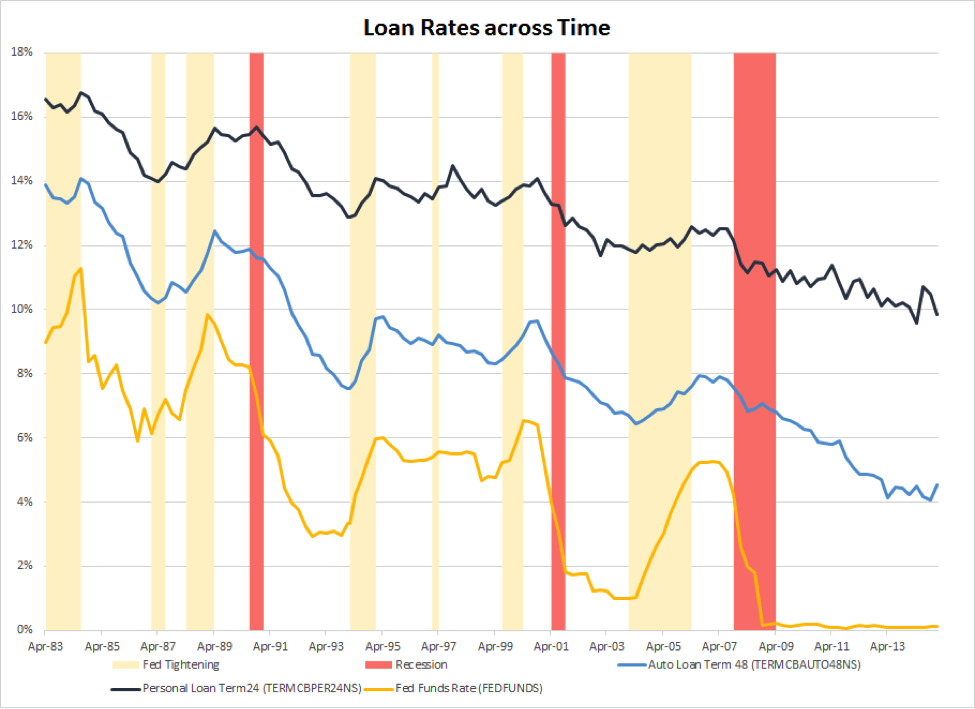

What To Expect: As the Fed hikes interest rates, investors should expect borrowing costs to increase across all forms of lending. Platforms will likely need to respond by increasing the coupons for newly issued notes. This action follows the historical trends from prior Fed interest rate hikes¹. Reviewing aggregated data of consumer loan products, periods of Fed tightening correspond to banks increasing the interest rates of consumer & other loan products².

Interestingly, the borrowing rates for personal & auto loans, while much more stable than the Federal Funds rates during periods of a rate hike, change at a different pace from one another. Auto Loans rates presented, which are secured and 48 months in term, shifted higher during the rate hikes compared to unsecured consumer loans with a term length of 24 months. This delta in a shift can be attributed to the different nature of the loans, such as term and sector. So it shouldn’t be a surprise that loan re-pricing will be different across the wide spectrum of marketplace platforms.

However, we still expect the general rate of reinvestment to rise in response to the rate hikes. With cash flows received from marketplace lending notes being reinvested in the on-the-run issues, the investor will benefit from the increasing coupon rates charged by the platform. The additional income from reinvesting at a higher rate further compensates any losses associated with the changes in the price mentioned earlier.

PREPAYMENT (TIMING) RISK:

What To Expect: Marketplace lending notes allow the borrower to deviate from their payment schedule, providing an option to retire the debt earlier by prepaying all or part of their loan. If interest rates rise, however, investors would benefit if the borrower makes these additional payments. An upward shift of the short end of the yield curve provides better investment opportunities for cash flows that are both scheduled and unscheduled. Investors can take further advantage of the rising reinvestment rates.

CREDIT RISK

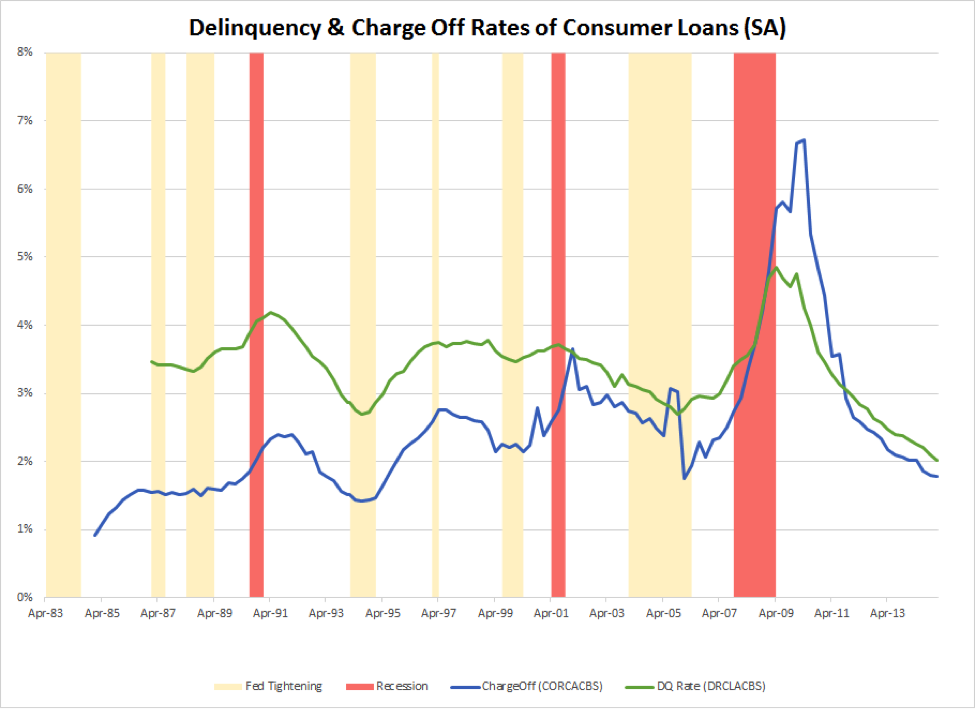

What To Expect: Holding quality of the borrower, the risk of default should be benign to a rising interest rate environment. Delinquency and charge offs are more strongly influenced by underlying macroeconomic conditions, such a recession, and unemployment³. An increase in borrowing costs shouldn’t motivate a borrower to default on their loan.

From the chart above, the rate of default rarely changed when the Fed begins to tighten. The only instance when charge-off rates grew during a Fed tightening cycle, June 2004 to August 2006, is more associated with changes in bankruptcy laws rather than Fed intervention4. The standard trend is default rates begin to move upwards when economic growth falters, the economy enters a contractionary period, and unemployment begins to rise. The greater concern is not the Fed Hike but it’s the impact on the overall health of the US economy, but that’s beyond the scope of this blog post.

CONCLUSION

While interest rates are currently steady, all signs point a rise happening later this year. As I have outlined in this post, the impacts of such an event may not be as bad as industry critics have feared. Nonetheless, it’s important for institutional investors to understand and anticipate impacts on their lending portfolios. Start by asking the following question in each area:

- Market Risk: What is the sensitivity of the instrument in response to an upward shift in the short end of the yield curve?

- Reinvestment Risk: What is your strategy to manage the difference in loan re-pricing across platforms and loan sectors?

- Prepayment Timing Risk: How can you take further advantage of the rising reinvestment rates with unanticipated cash flows?

- Credit Risk: Default risk is less influenced by an interest rate hike (phew, off the hook!), but it is exposed to the overall health of the economy. What is your forecast of the US Economy in the coming year?

Marketplace lending responds differently from other traditional fixed income instruments in a rising interest rate environment. All investments have risk but the difference in their exposure provides opportunities to diversify away from a concentrated risk. Investors must appropriately understand the nature of each risk and measure the expected value of the investments return. After that, they can best decide if marketplace lending is a suitable investment given their risk/return profile.

______

¹Source for Dates of Fed Tightening: http://www.businessinsider.com/history-of-federal-reserve-tightening-2013-1

²Source for Data: FRED®

3Source for Recession Dates: http://www.nber.org/cycles.html

4https://research.stlouisfed.org/publications/review/07/01/Garrett.pdf