A few weeks ago Simon Cunningham at Lending Memo wrote a great post on algorithmic investing in marketplace lending. There is a perception that institutional investors are buying the best loans using credit models. This is a good assumption. But it’s also worth asking: do institutional investors really behave differently from retail investors on the marketplace lending platforms?

A convenient way to segment the largest investors vs retail and smaller institutional investors is by comparing the whole loan vs fractional market. Whole loans have certain legal advantages compared with fractional loans; beyond that, large institutional investors use the whole loan market as a way to get the necessary purchase volume of loans to fuel their AUM growth.

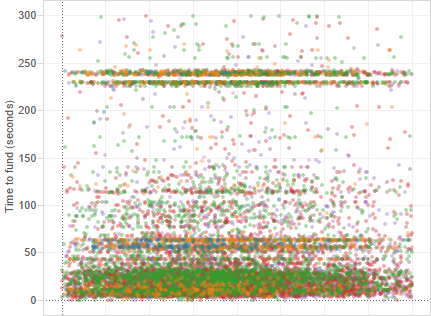

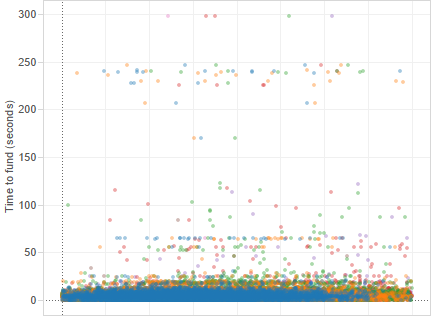

Here are two graphs showing the purchasing speed on the fractional vs whole-loan markets on Lending Club:

Fractional Loan

Whole Loan

The difference is remarkable. The fractional market purchase time is fairly drawn out; many loans are still available 30 seconds after the start of the auction, which is enough time for non-API investors to choose. Lending Club has implemented several measures to ensure the fractional market is still accessible for retail, non-automated investors. It clearly works.

The whole loan market is a different story: over half of the volume is gone within the first 5 seconds after release. Indeed, most quantitative managers we work with regularly purchase loans within a fraction of that time frame.

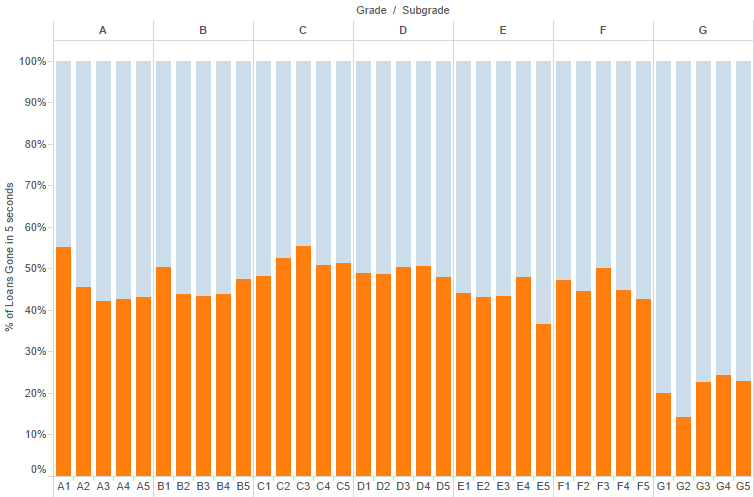

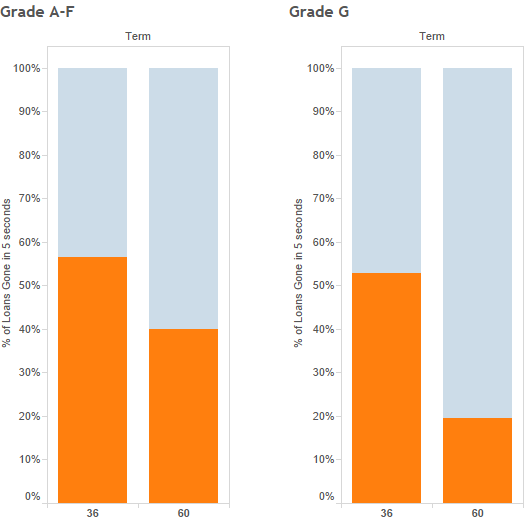

Here are some of the key characteristics we see with whole loans that have been purchased under 5 seconds:

1. All Grades – Except for G

This was a big surprise to us when we saw it. There was a presumption that fast institutional investors (particularly hedge funds) are mainly interested in purchasing lower grade, higher yielding loans. Turns out this is not true.

While lower grade loans can be popular due to the higher yield, the higher grade loans also have attractive risk/return characteristics, particularly for managers that utilize leverage in their portfolios. The well-balanced pool also reflects well on Lending Club’s management of loan supply vs demand, while their underwriting volume is growing rapidly.

The one grade that’s still not getting much love from the fast whole loan buyers is Grade G. Lending Club’s own return chart shows an underperformance of the lowest grades – this may change as Lending Club optimizes the underwriting for the higher risk borrowers (including programs like policy code 2).

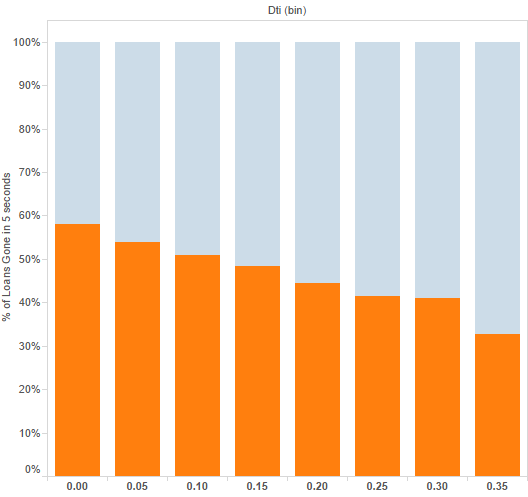

2. Low Debt-to-income Ratio

The debt-to-income ratio consistently shows up as an input in institutional investors’ strategies, and the purchase pattern tells a pretty clear story. Most of the fast buyers favor low DTI strategies by a significant margin.

3. Shorter Term Loans

Since marketplace lending loans still haven’t gone through a full credit cycle, many investors still prefer the shorter 36 month term loans over the 60 month loans. This bias is particularly strong for Grade G notes, where the exposure to downside risk is the highest over time.

What’s next?

Fast investors’ buying patterns are interesting. But the more unexpected findings come from understanding what many of them don’t use in their purchasing algorithms. Our next post will highlight some of these anti-patterns.