MonJa Launches Advanced Fraud Detection Feature for Safer Document Analysis. LEARN MORE

Get exclusive MonJa Co. insights on document automation before you leave

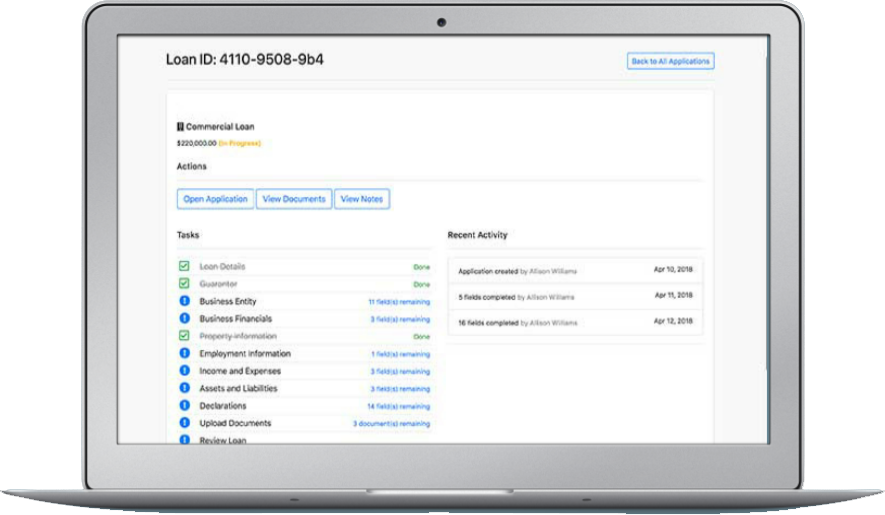

Increase efficiency and process 10x more loan applications than manual data extraction.

Guard against losses with comprehensive fraud detection, including bank statements, tax returns, and other financial documents.

Source of Allocations and

Excess Returns

Standard and Customs Benchmark Comparison